FRANCHISE

AGREEMENT

SURVEY REPORT

MARCH 2017

Published by the League of

Oregon Cities

LEAGUE OF OREGON CITIES

1

Franchise Agreement Survey Report

Technical Report

March 2017

A League of Oregon Cities study of utility franchise agreements found striking new information on

franchise revenue and fees. Since the early 2000s, telecom revenue has been declining as cable revenues

have increased. This difference masks the aggregated trend in the revenue. Combined, city franchise

revenue from these two major sources have been declining. Adjusted for inflation, this decrease is

even greater.

League of Oregon Cities Franchise Agreement Survey Report

2

Executive Summary

Since 2002, the League of Oregon Cities has periodically surveyed its membership in order to update data

pertaining to the types, bases and rates that they charge franchisees operating in the public rights of way

owned by cities. This data

helps cities

understand how other cities manage their rights of way and

receive compensation for them, and is crucial to the understanding of revenue sources available to cities.

The 2015 survey was conducted between October and November 2015.

Responses were received from

91 cities, representing 66 percent of the Oregon population residing in a

city

.

Key Findings

The 2015 survey is very revealing about the second largest revenue collected by most cities. The key

findings include the following:

• Revenues derived from telecommunications franchise fees have been declining since 2002.

• Cable franchise fee revenues, on the other hand, have increased significantly since 2000.

• In the aggregate, both telecommunications and cable franchise fee revenues have remained

relatively flat when adjusted for inflation. When also adjusted on a per capita basis, the data

shows a decline among respondent cities.

• While only a few cities pay franchise fees to other governments, fully one-third of them charge

themselves franchise fees (typically for water, wastewater or stormwater services).

Background

Franchise fees (also sometimes referred to as privilege taxes) are a legal agreement between a city and

another entity involving compensation for the entity’s use of the city’s right of way. These agreements

can include a contract negotiated individually by a city and its utility providers, or an ordinance approved

by a city council. In either case, the agreement usually outlines the rate charged, the terms and

conditions, and any special services provided by either party.

These agreements ensure that companies using a right of way are paying fees to reimburse a local

government for the use of public property. They also prevent general taxpayers from subsidizing

extraordinary use. Franchise fees are typically calculated as a percentage of the sales revenues of a utility

company to customers in a given service area or territory. In light of Oregon’s restrictive property tax

system, diminution of franchise fees would have a very detrimental effect on city fiscal capacity.

Survey Results

Telecommunications franchise agreements are most often established by ordinance (72 percent), but are

also created by a contract with the service provider (20 percent). The remaining 8 percent includes

agreements that result from a city council resolution or situations in which the franchisee operates without

an agreement. The franchise fee is usually, although not universally, charged in lieu of a general business

license fee or tax. Agreements which include a contract have an average duration of 11 years.

League of Oregon Cities Franchise Agreement Survey Report

3

By state statute, the basis for franchise fees charged to a traditional incumbent local exchange carrier

(ILEC) is gross revenues derived from dial tone (basic telephone connection) services provided to

customers within a city’s jurisdiction. It does not account for the myriad of other revenue-producing

services currently provided by ILECs. On the other hand, there is no restriction on the basis for franchise

fees charged to competitive local exchange carriers (CLEC), the independent, often smaller and

geographically specific telecommunications companies that have sprung up since deregulation of the

industry in 1996.

Similar to telecommunications agreements, 67 percent of cities responding to the survey enter into

agreements with cable franchises by ordinance; 21 percent do so by contract. The median length of cable

agreements is slightly more

than

10 years.

In addition, cities can grant right-of-way access to other governments and charge them franchise fees for

doing so. Cities also charge themselves franchise fees to facilitate proper accounting for a city business

activity. This is most commonly practiced by larger cities and most often occurs in the Portland

metropolitan area. The most common franchise fees local governments

charge

themselves are for water,

wastewater and stormwater services.

As the report demonstrates, while franchise agreements with telecommunications providers represent a

significant source of such revenue to cities, these other services provide franchise revenue as well:

• Electricity

• Natural gas

• Solid waste disposal

• Water

• Wastewater

Conclusion

Because Oregon is a home rule state, cities can govern themselves in areas not specifically preempted by

state or federal law. With right-of-way management and franchise fees, cities have local control of their

individual relationships with utility service providers. This is a principle which the League of Oregon

Cities will continue to protect.

Any preemption of a city’s right to enter into franchise agreements (via ordinance or contract) with its

service providers will be resisted. Similarly, attempts to create a universal methodology for the

administration of franchises and the collection of fees will also be opposed, as they fail to take local

circumstances into consideration.

Rights of way in the public domain are government’s responsibility to manage and maintain, and cities

take this responsibility very seriously. The fees charged for the occupancy of such a right of way are

critical to the financial health of cities and should be viewed as a normal cost of doing business by an

entity reliant on that access.

As policy discussions unfold, either in the Legislature or in agency rulemaking, these basic tenets will

govern the League’s response.

League of Oregon Cities Franchise Agreement Survey Report

4

Introduction

A revenue-expenditure imbalance for cities has resulted from the combination of Oregon’s restrictive

property tax system and an increase in expenses beyond city control. The importance of property tax

revenues to cities cannot be overstated. They are the single highest and most flexible revenue source

for

funding core city services such as public safety and street projects.

In a recent League of Oregon Cities survey

1

, costs associated with employees (wages, healthcare and

retirement) were identified by cities as the three highest cost drivers. Controlling the top three expenses is

beyond a city’s ability—as they are controlled by market factors and state and federal regulations. To

maintain services to their communities, cities are looking to revenue sources other than property taxes. In

a 2014 League survey

2

, 54 percent of respondents cited franchise fees as either the second or third highest

revenue source.

Since 2002, the League surveys its members every few years to collect and analyze data on the status of

franchise agreements throughout the state, with the last survey conducted in 2011. The survey asks cities

to provide their most recent rates and rate calculations for telecommunication and cable franchises.

Questions are also posed for other franchises, such as electricity, water, garbage, and franchises to other

governments. This information is crucial to understanding revenue sources in Oregon cities and to

forecasting future revenue trends.

Methods

This survey was conducted from October 30 to November 30, 2015 and received responses from 91 cities.

These cities represent 1,801,900 residents, or 66 percent of the population residing in a city in Oregon.

The League created the survey using software from

Qualtrics and

distributed it to city managers,

city

recorders, and other individuals with positions equal to a city’s chief executive officer. These individuals

often relied on support from relevant city staff or forwarded the survey to be completed by that individual.

1

League of Oregon Cities 2015 State of the Cities Report

2

League of Oregon Cities 2014 State of the Cities Report

League of Oregon Cities Franchise Agreement Survey Report

5

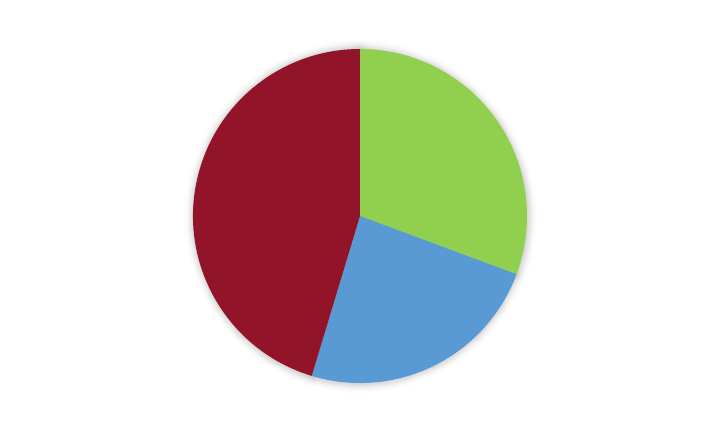

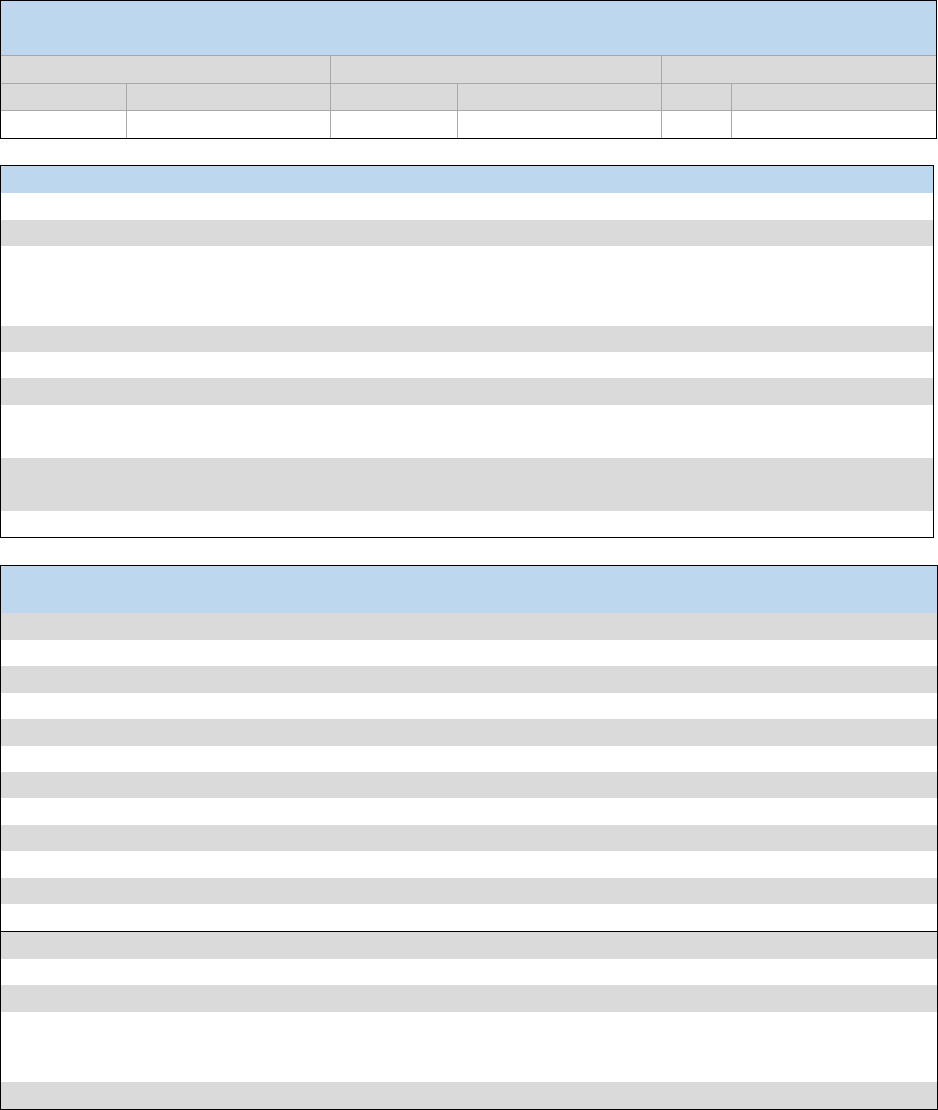

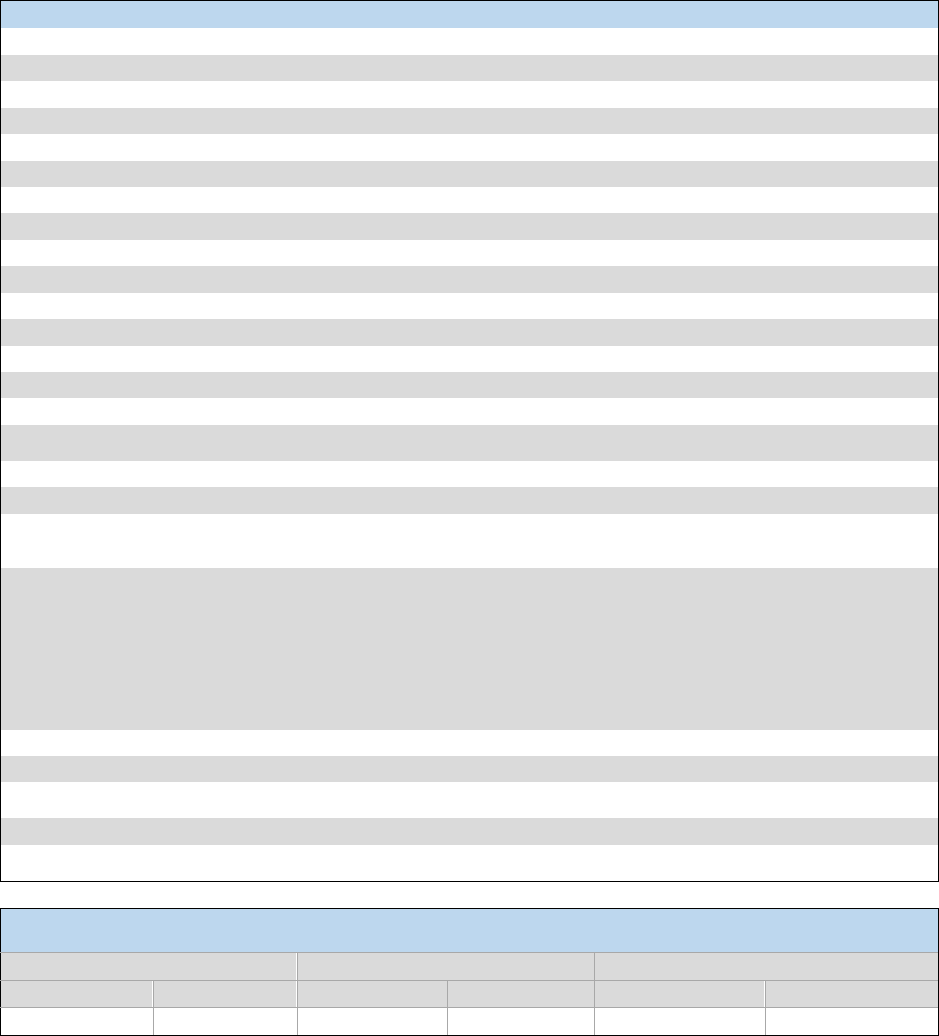

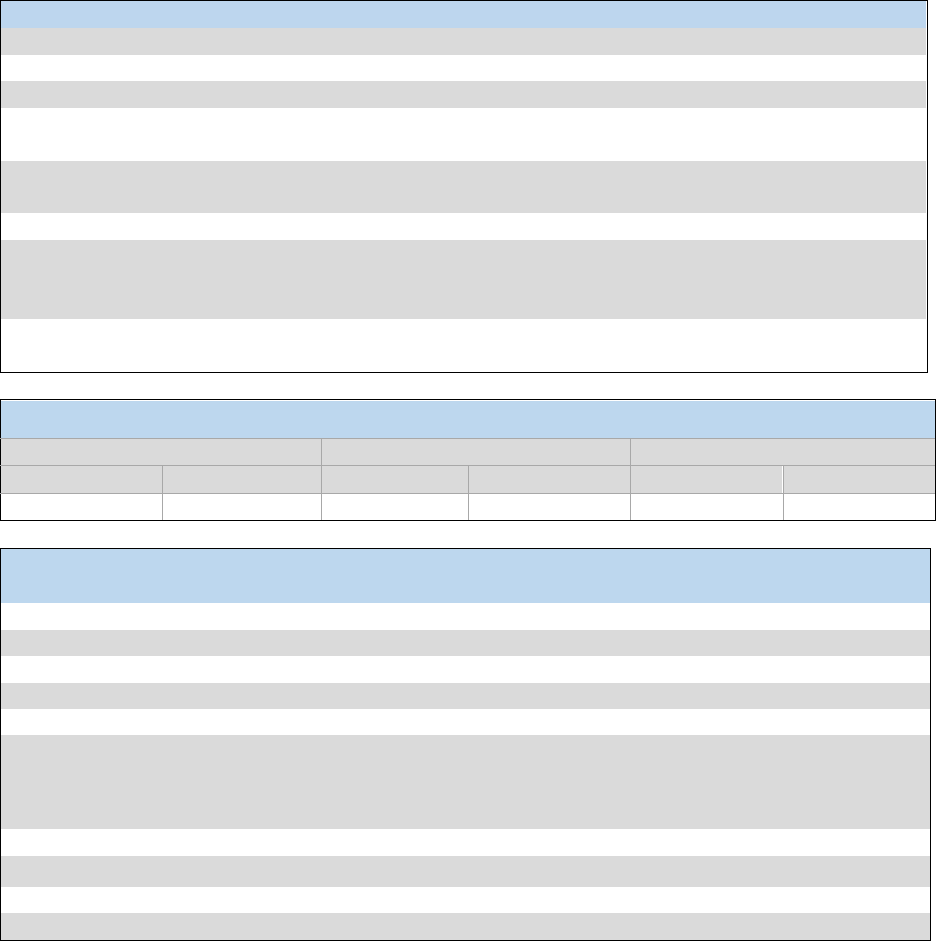

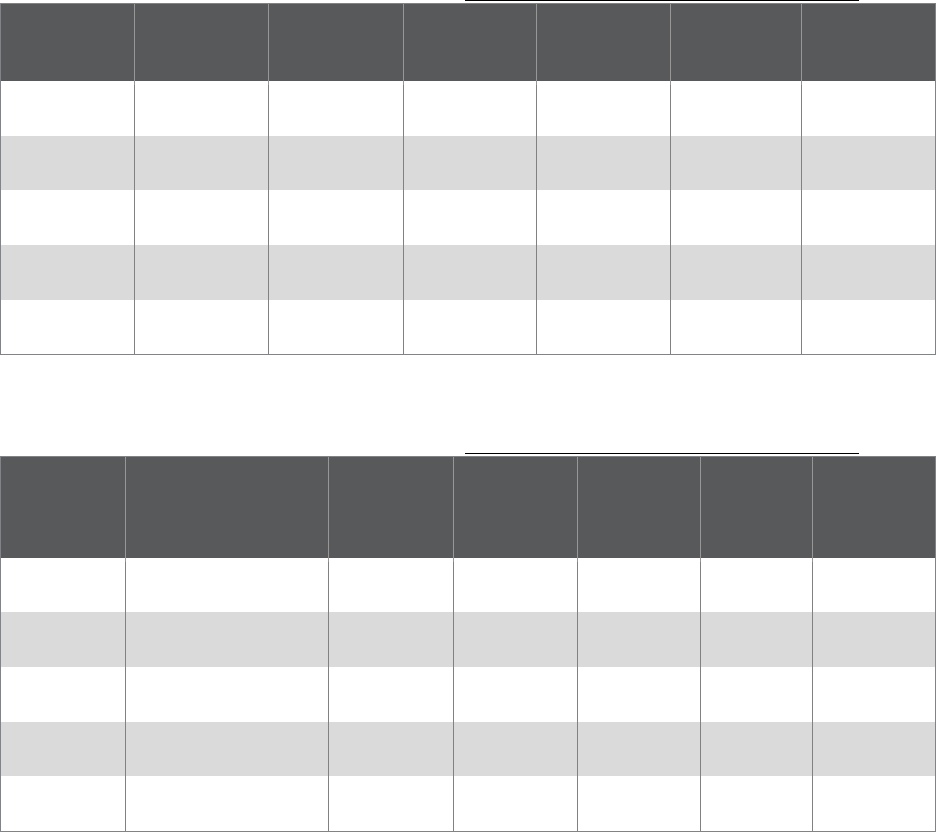

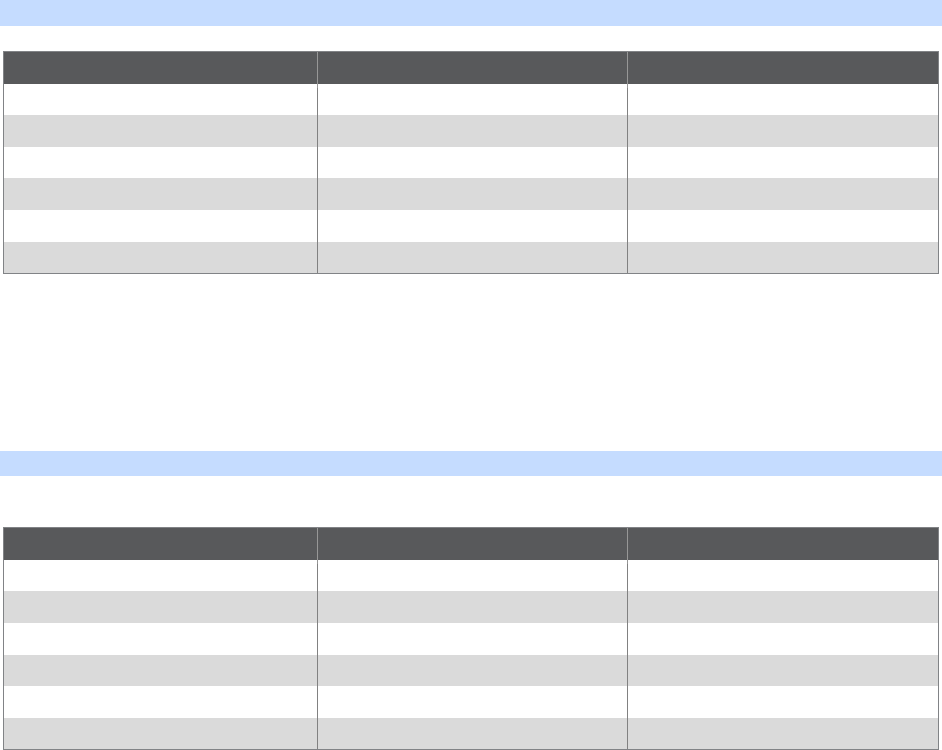

Figure 1: Respondent Population Proportionate to Oregon Urban Population

For data analysis, cities are divided into population quintiles, or groups of cities representing roughly one-

fifth of the 241 total cities. This allows for a more accurate comparison among similar sized cities. If

LOC randomly selected cities from each quintile, we would expect 20 percent to come from each of the

five quintiles. Among these respondent cities, there was overrepresentation in cities more than 10,000

population and underrepresentation in cities between 1,251 and 3,100 population. Further, with the

exception of the Valley and Eastern Oregon, all other small city regions as defined by the League were

represented proportionately.

Category

Population Range

# Cities

% Cities

Diff. from OR Population

1st Quintile

<450

18

20%

0%

2nd Quintile

451-1,250

18

20%

0%

3rd Quintile

1,251-3,100

10

11%

-9%

4th Quintile

3,101-10,000

17

19%

-1%

5th Quintile

>10,000

27

30%

10%

Region

# Cities

% Cities

Diff. from OR Population

N. Coast

6

7%

-1%

Metro

22

24%

0%

Valley

21

23%

6%

S. Coast

4

4%

-1%

S. Valley

10

11%

-2%

Central Oregon

12

13%

2%

NE Oregon

10

11%

-1%

E. Oregon

5

6%

-4%

TOTAL

91

37%

Table 1: Respondent Characteristics by Population and Region

Respondent

Cities

66%

Other Cities

34%

League of Oregon Cities Franchise Agreement Survey Report

6

Survey Results

Telecommunication Franchises

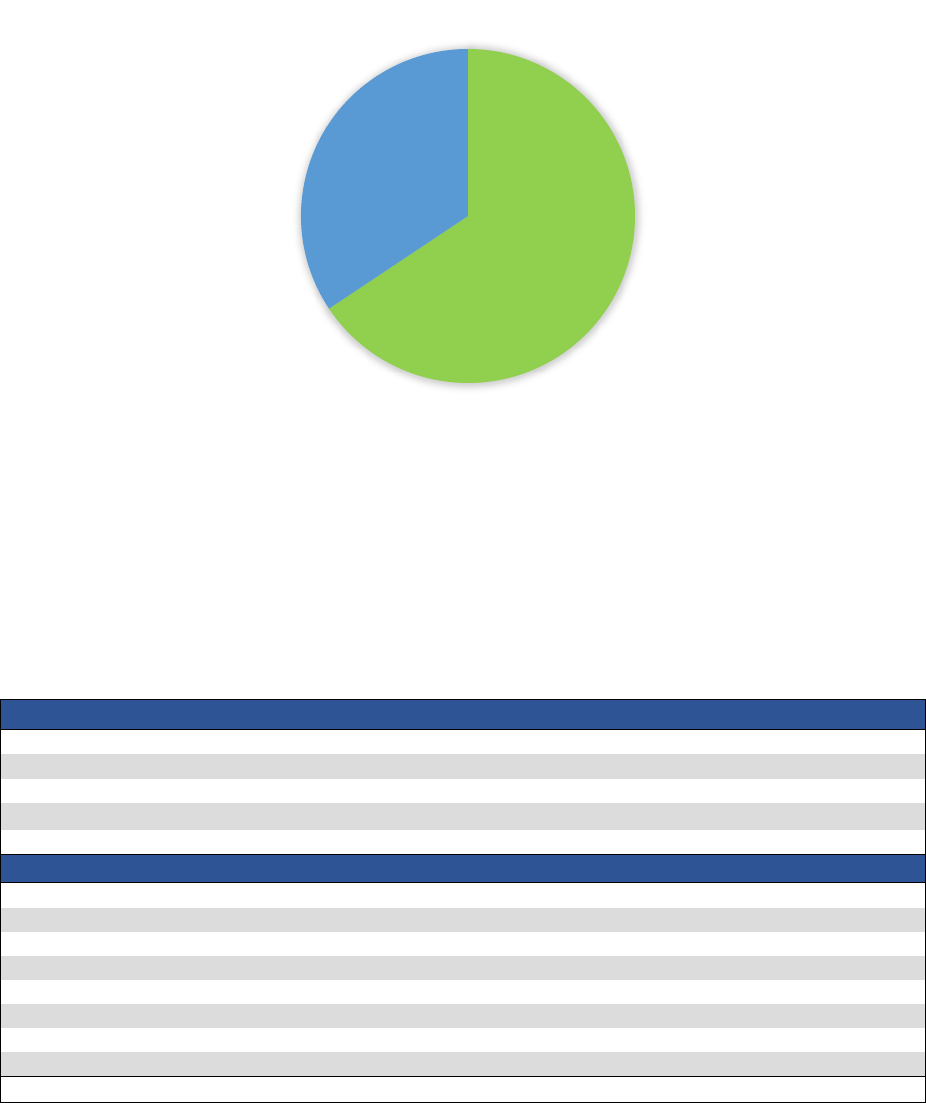

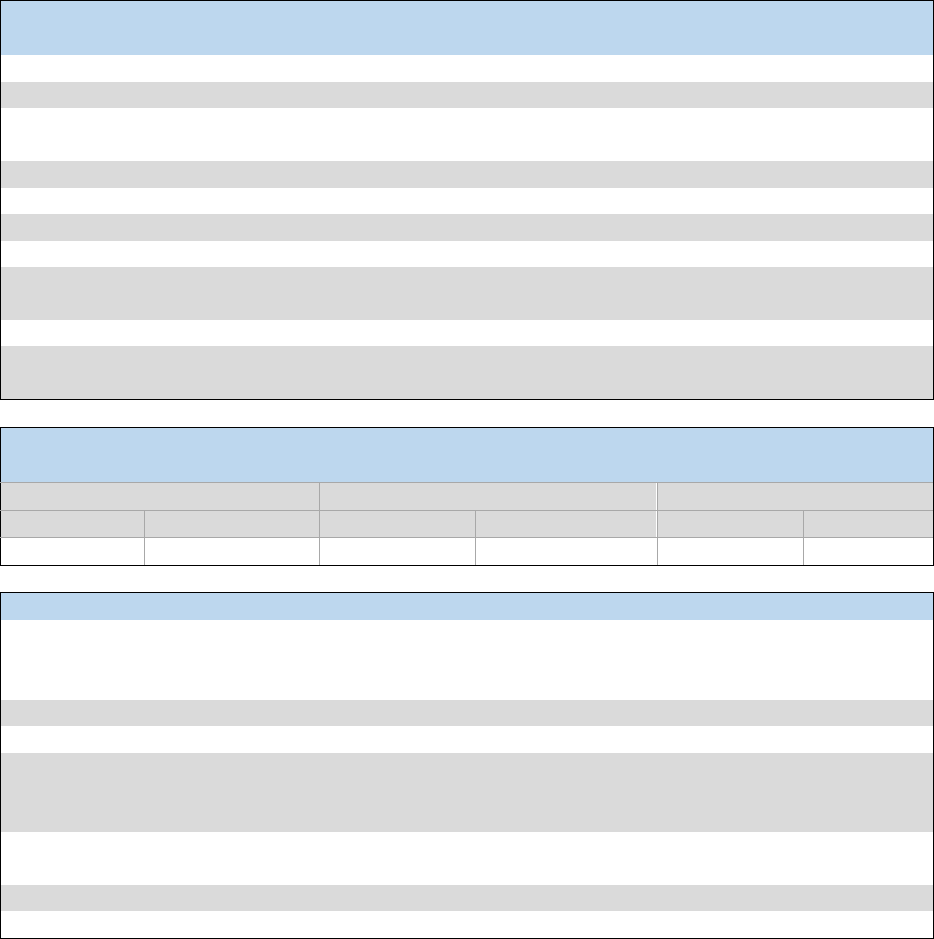

Figure 2: Telecommunications Franchise Establishment Method

Telecommunications franchise agreements are one of the largest sources of revenue generated in a city’s

right of way. According to the survey, 72 percent of responding cities indicated their telecommunications

agreements are established by ordinance. Twenty percent establish theirs by contract, while the

remaining 8 percent reported using other means, most commonly through city council resolution. While

agreement duration ranged from three years to “open ended,” the average duration was 11.1 years,

indicating that most telecommunications agreements are established for the long term.

Cities address the unique position of providers that operate in the right of way differently. Seventy-nine

percent of cities do not require telecommunications providers to pay a general business license fee or tax.

This occurs more often in the Metro region and less likely to occur in the Valley region. This added cost

in those cities that require telecommunications franchises to pay additional fees or taxes is typically less

than $100 per year. This fee is often charged based on the number of telecommunication company

employees within city limits. Cities also may charge permit fees for a company to operate in the

municipal right of way. Seventeen percent of cities charged this fee, 94 percent of which were in cities

with populations greater than 3,100. This was also more likely to occur in the Metro region. Among the

17 percent of cities that have a permit fee, 41 percent of these waive the fee for telecommunications

providers.

Contract

20%

Ordinance

72%

Other

8%

League of Oregon Cities Franchise Agreement Survey Report

7

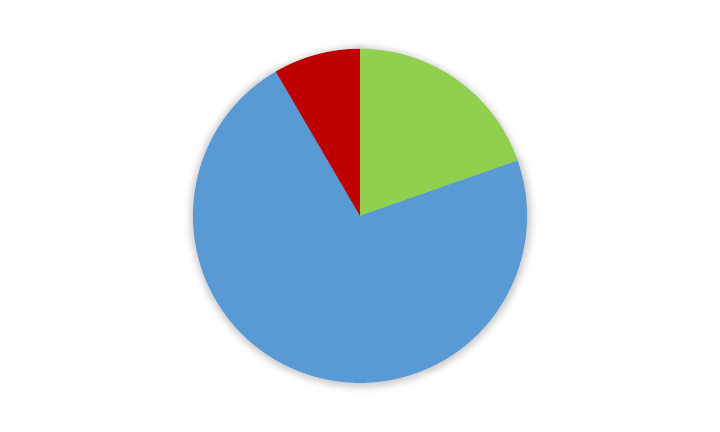

Figure 3: Does Your City Have Telecommunications Towers on Public Property?

Cell towers and telecommunications towers are often placed on public property within city limits. While

the median number of cell towers in respondent cities was one, this number can vary tremendously.

Portland lists more than 900 cell towers within city limits. Among respondent cities, 36 percent report

telecommunications towers on public property. Again, this is most likely to occur in larger cities (with a

population more than 10,000) and in the Metro region. Fifty-six percent of respondents do not have

telecommunications towers on city property. This is most likely to occur in cities with a population less

than 1,250. The monthly lease rate for the property on which these towers stand ranges from $330 per

month to $5,000 per month. The lease rate depends on the city and the nature of the individual agreement.

Cities may also charge telecommunications providers to replace wireless attachments on utility poles in

the right of way. However, 70 percent of cities do not charge for these attachments.

Cable Franchises

Cable franchises, similar to

telecommunications

franchises, are the other major category of franchise

agreements examined by this

survey. Sixty-seven percent of cities surveyed establish cable agreements

by ordinance, and 21 percent do so as a contract. These proportions are similar to telecommunications, as

is the median length of cable agreements (10.3 years).

Yes

36%

No

56%

Unsure

8%

League of Oregon Cities Franchise Agreement Survey Report

8

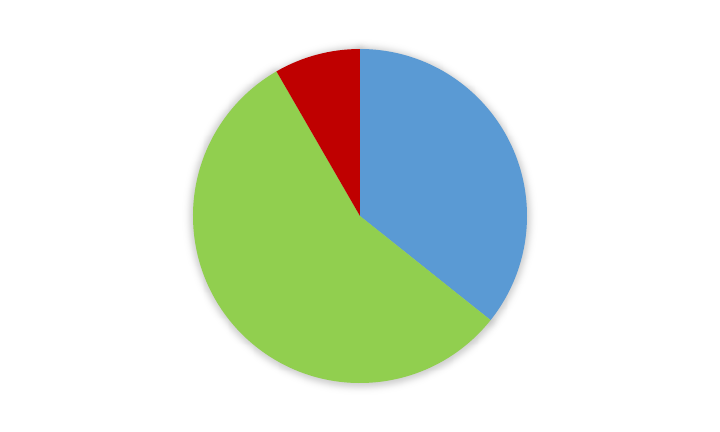

Figure 4: Voice-Over-Internet-Protocol in Cities

There are, however, notable and fundamental differences between cable and telecommunications

agreements. Cable franchises in the last several years have begun offering voice-over-internet-protocol

(VoIP), which allows for phone calls via internet connection. Thirty-one percent of cities responded to

having VoIP as part of their cable franchise agreement. This figure is higher than the League’s

2011

survey (26 percent), indicating an increase in the service offered. This service was statistically more likely

to be offered in 5th quintile cities as well as in the Metro region.

Large cities and cities in the Metro region were also more likely to have added provisions in their cable

agreements. Forty-two percent of cities (66 percent of these in cities with a population greater than

10,000) had additional provisions. The most common added provisions included free or reduced prices

for cable in city government facilities, or public, educational and government access (PEG) channels.

Like telecommunications, business licenses and taxes are usually not charged to cable utilities.

Eighty

-

two percent of cities do not impose license fees. This is also statistically less likely to occur in the Valley

region.

Government Franchises

A city right of way is most often granted to utility providers. This, however is not exclusive to private

firms and can also be granted to other government entities. These government franchises can take the

form of franchise fees to other governments (cities and special districts) or franchises charged to the city

itself. This latter charge (often called an in-lieu-of franchise) is most often used for city business

activities as an accounting practice. While 85 percent of cities do not charge government franchises,

larger cities and those in the

M

etro region are most likely to have such arrangements.

Most common

in-lieu

-

of franchises are cha

rged for water, wastewater

and stormwater utilities. All these are most often

owned by the city. Ninety-five percent of cities do not pay franchise fees to other governments.

Yes

31%

No

24%

Unsure

45%

League of Oregon Cities Franchise Agreement Survey Report

9

Other Franchises

While telecommunication and cable franchise fees are l

arge revenue sources in a city, other services

provide franchise revenue as well. These include:

• Electric (often the largest source of franchise revenue)

• Natural gas

• Solid waste

• Water

• Wastewater

• Other

Other franchises can vary dramatically based on a city’s region and local economy. For example, Salem

and Portland both have flat fee franchises charged to universities. Portland has several franchises with

private companies that operate oil and gas pipelines, cement production, and sustainable energy.

Analysis

The League has telecommunications revenue data from 58 cities dating back to 2002. Analyzing

aggregated data in this manner can be performed in two ways. First, by examining revenues nominally,

or by looking at revenue as the simple dollar amount. Issues arise with this figure when considering

inflation. Inflation produces a situation in which $10 today will be worth less in the future. As a result,

telecommunications revenue is shown below as both nominal and adjusted to account for inflation.

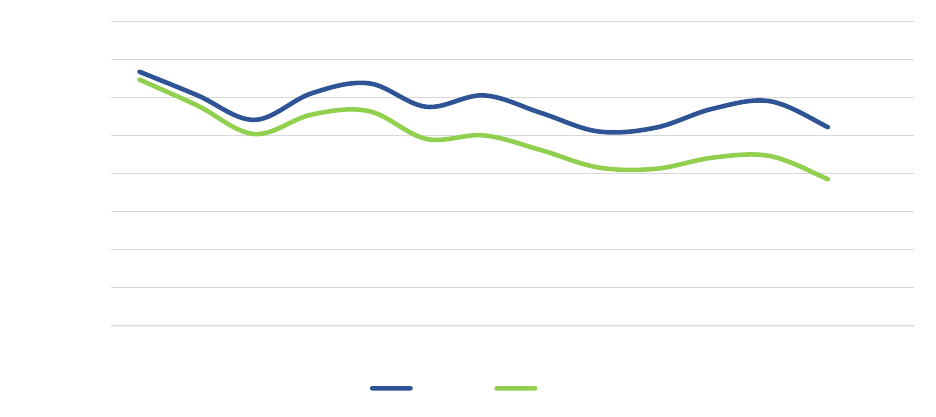

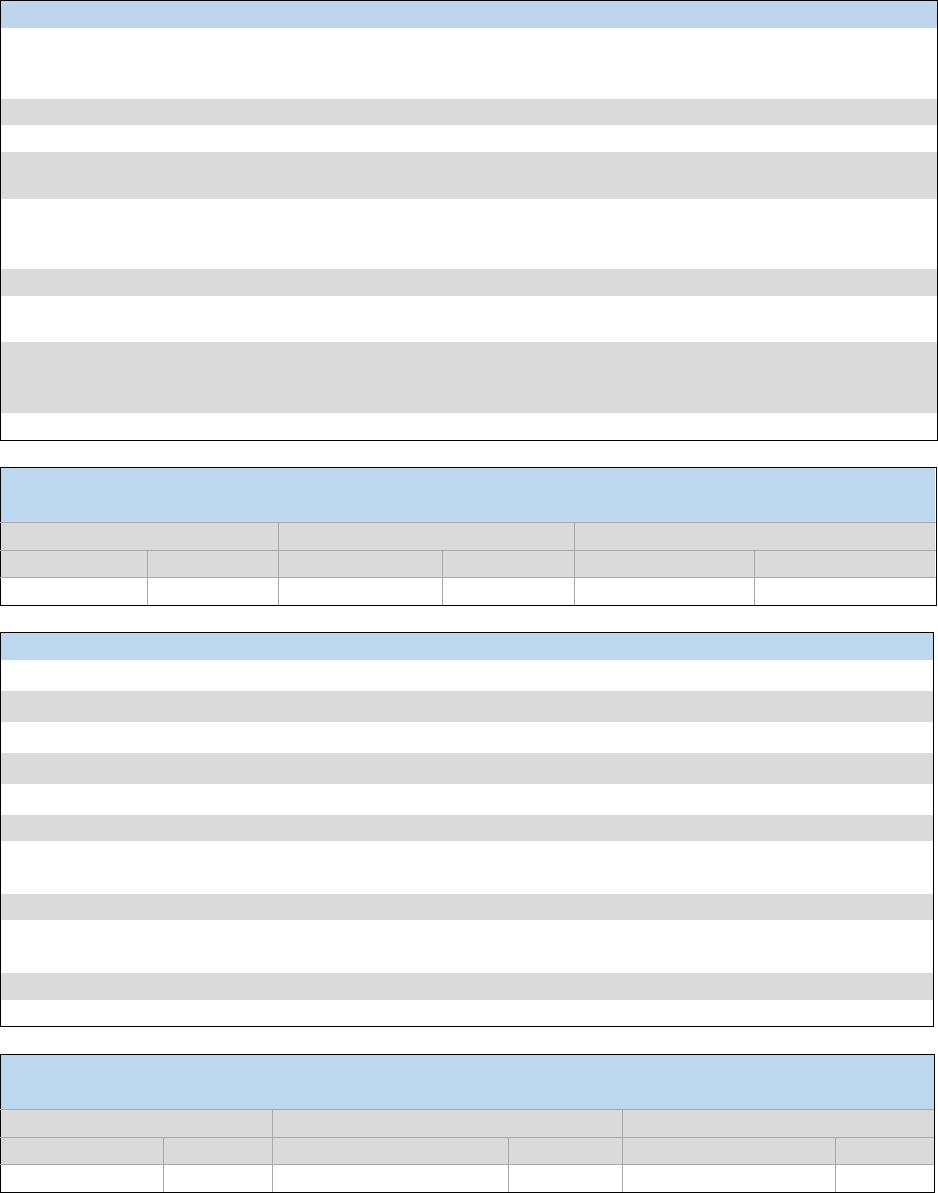

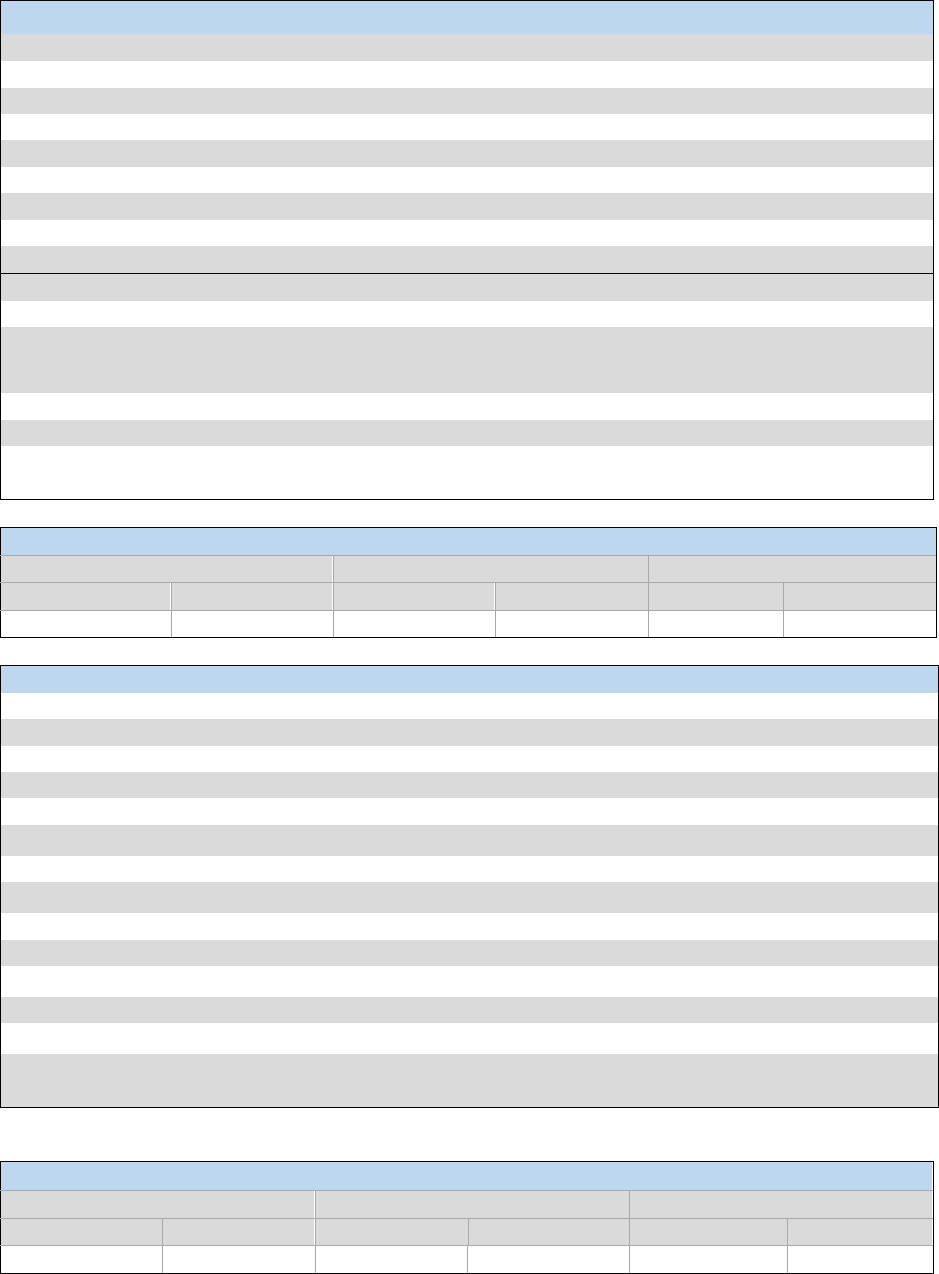

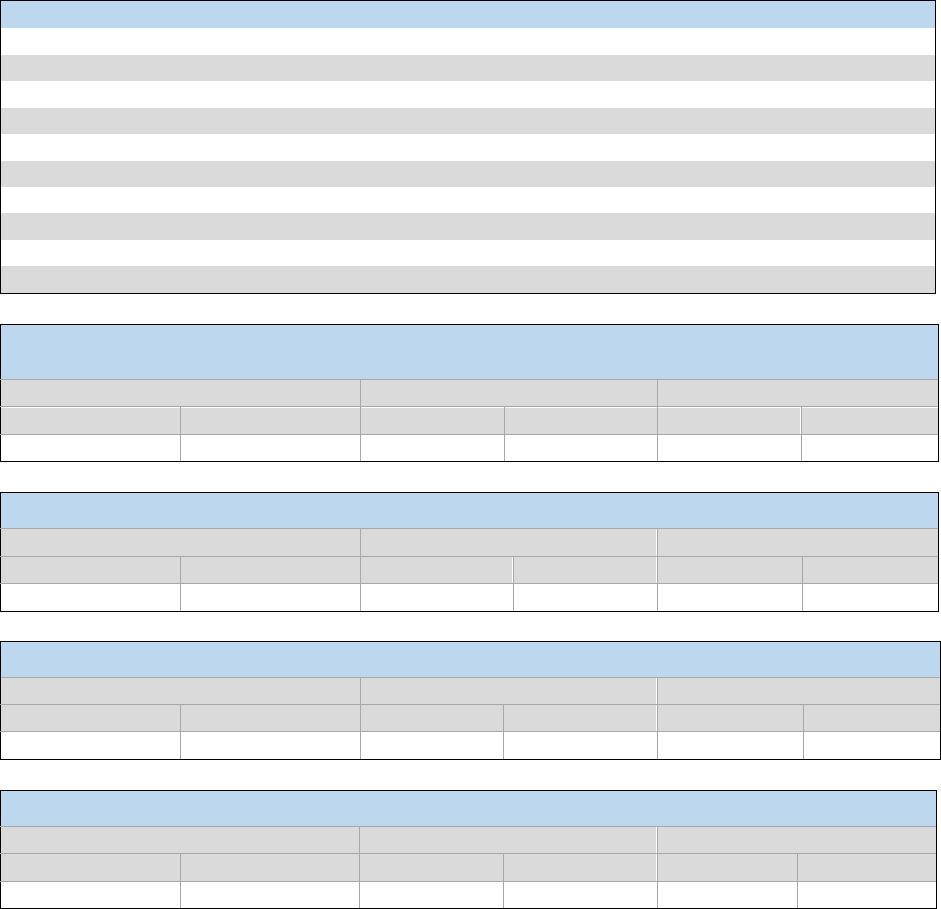

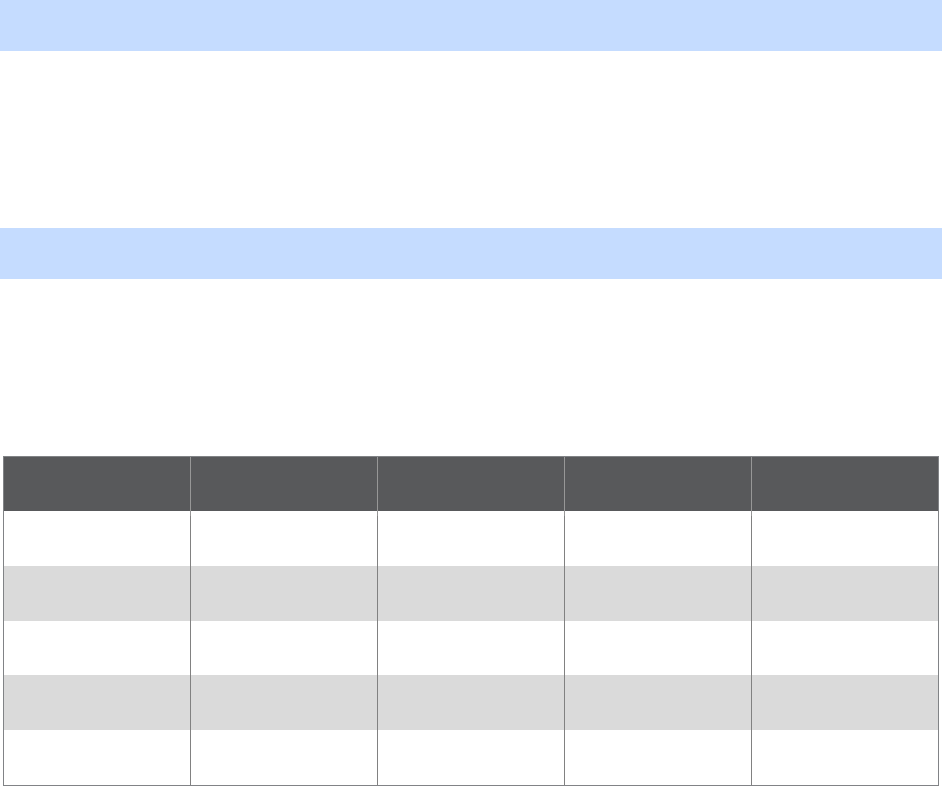

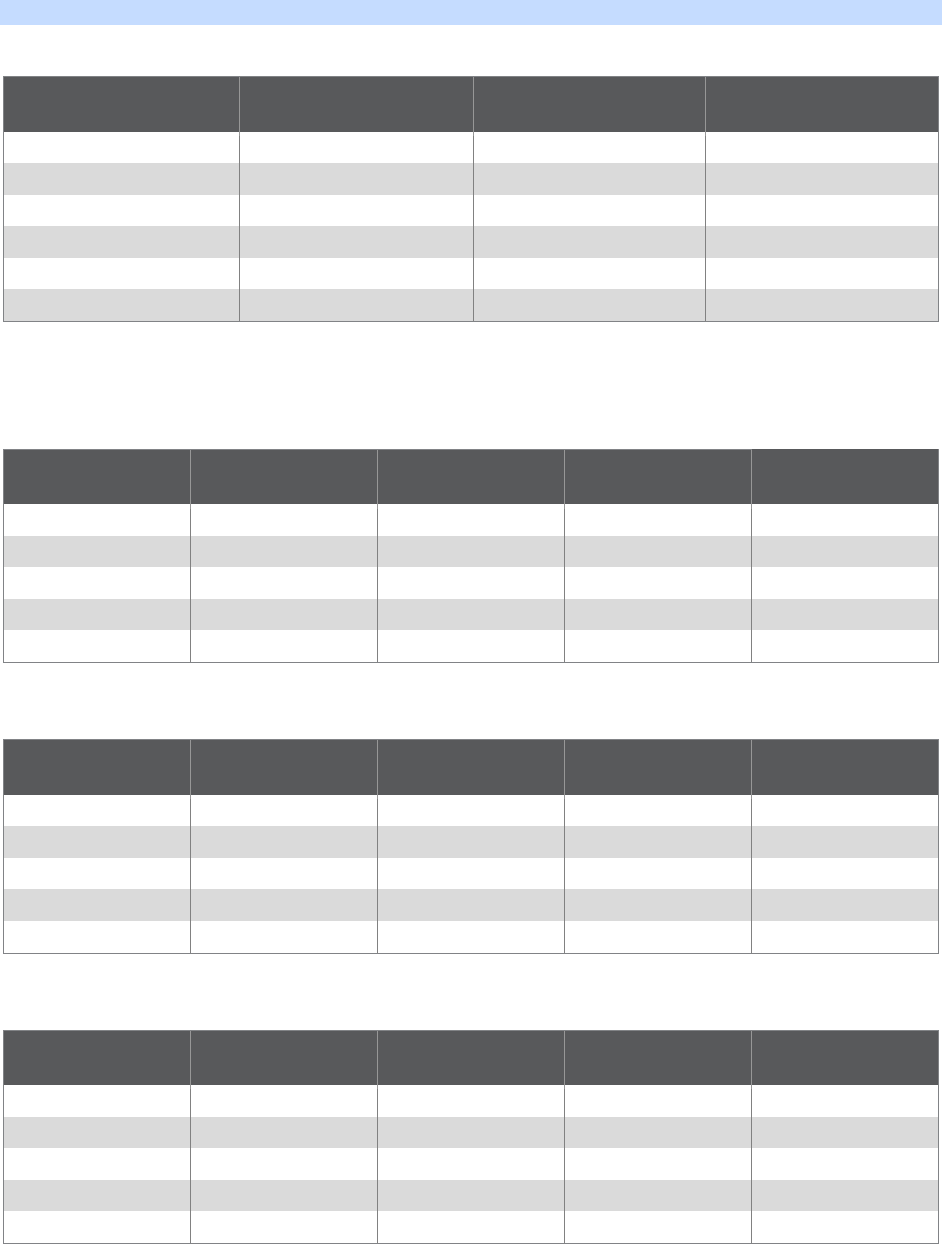

Figure 5: Telecommunications Franchise Revenue

While the nominal data indicates a gradual decline in franchise revenue, the inflation adjusted (or real

dollar amount) shows a much steeper decline in the amount of revenue collected by cities from

telecommunications utilities (Figure 5). This trend is partially due to the fact that fewer residents use

$0

$1,000,000

$2,000,000

$3,000,000

$4,000,000

$5,000,000

$6,000,000

$7,000,000

$8,000,000

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Nominal Real

League of Oregon Cities Franchise Agreement Survey Report

10

landline phones. This data indicates that less revenue will be available from telecommunications

franchise in the future.

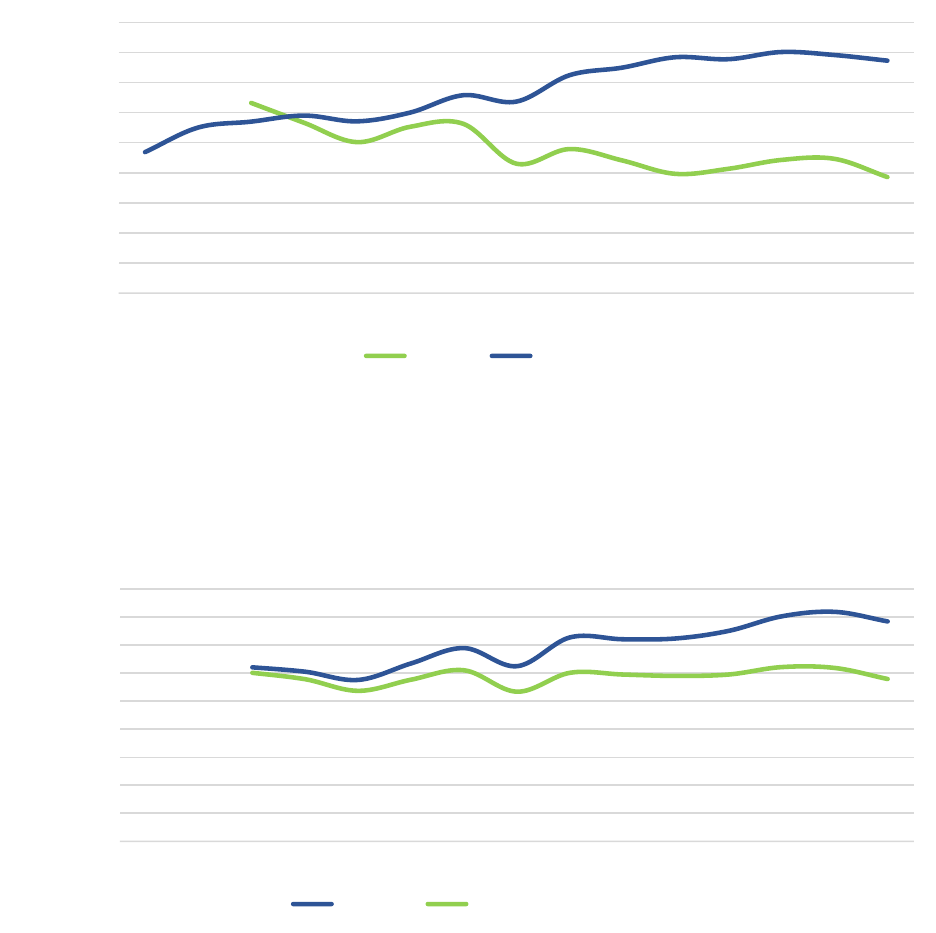

Cable revenues are a more positive trend. Figure 6 shows that even after adjusting for inflation, cable

franchise revenue is on the rise. Much of this change can also be explained by changing behavior on the

part of the end user, as more and more hours are spent daily using services online. Cable companies also

have an advantage in some areas of Oregon with the VoIP services that could displace telecomm-

unications further in coming years.

Figure 6: Inflation Adjusted Telecommunications & Cable Revenues

When these two revenue sources are combined, the results (Figure 7) shows that while adjusted for

inflation, revenues in telecommunications and cable franchise remain relatively steady. Among the cities

for which the League has long-term data, revenue has remained flat since the early 2000s except for a

slight downturn during the recent deep recession.

Figure 7: Aggregated Telecommunications and Cable Revenues

It should be noted that this pool of revenue has been flat in these cities for more than 12 years. However,

this has not halted the influx of new residents and subsequent increase in population. Larger populations

$-

$1,000,000

$2,000,000

$3,000,000

$4,000,000

$5,000,000

$6,000,000

$7,000,000

$8,000,000

$9,000,000

2000 2001 2002 2003 2004 2005

2006

2007 2008 2009

2010

2011 2012 2013 2014

Telecom Cable

$0

$2,000,000

$4,000,000

$6,000,000

$8,000,000

$10,000,000

$12,000,000

$14,000,000

$16,000,000

$18,000,000

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Nominal Real (Inflation Adjusted)

League of Oregon Cities Franchise Agreement Survey Report

11

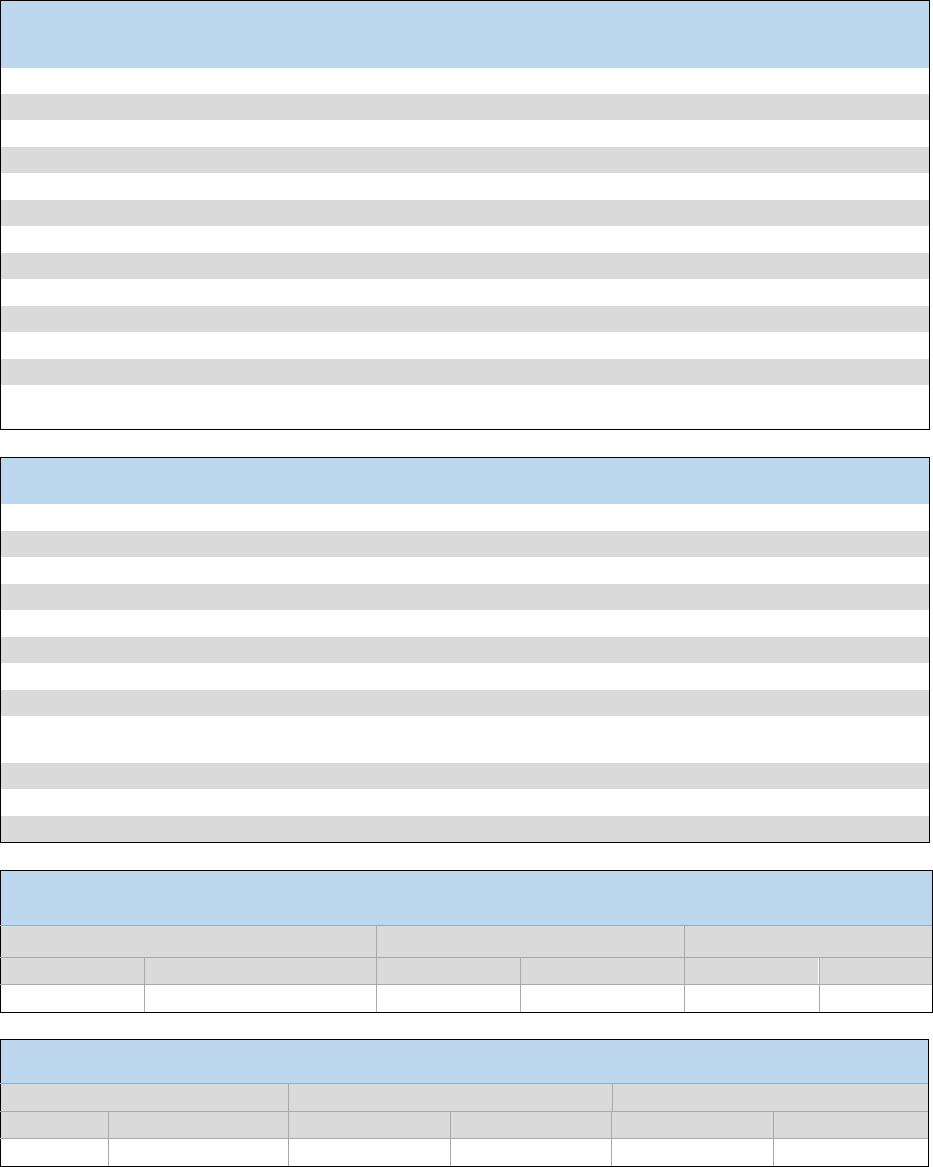

mean less money per person for essential city services, the results (Table

2) is that cities receive less

revenue per capita over time.

Aggregate Telecommunications and

Cable Per Capita (2002-2014)

Nominal

Real

2002

$ 13.78

$ 13.34

2014

$ 14.45

$ 10.66

Change

5%

-25%

Table 2: Aggregate Telecommunications and Cable Revenues per Capita

The League has relatively complete data for telecommunications and cable franchise revenue but

unfortunately not for other major franchise revenues, such as electric utilities. Yet, for the few cities that

have submitted such data in the past, the same trend appears true of electric franchises as well. For the 14

cities that have submitted data, electric utilities revenue has increased 22 percent in the aggregate since

2007.

When adjusted for inflation, this number is only 6 percent.

Summary

Charges for the use of a city’s right of way take many forms and are ofte

n dependent on a city’s size,

location and history.

In general, larger cities and those in the Metro region tend to have the most complex

franchise agreements, as well as the most unique sources of franchise revenue. Universally, however,

franchises represent an essential revenue source for all Oregon cities.

Analysis of city revenue over the last decade reveals that franchise revenue is either steady or in decline.

In most circumstances, these revenue sources are spread increasingly thin due to population growth.

While telecommunications and cable were the primary focus of the research, this trend appears to be true

for other franchises as well.

League of Oregon Cities Franchise Agreement Survey Report

12

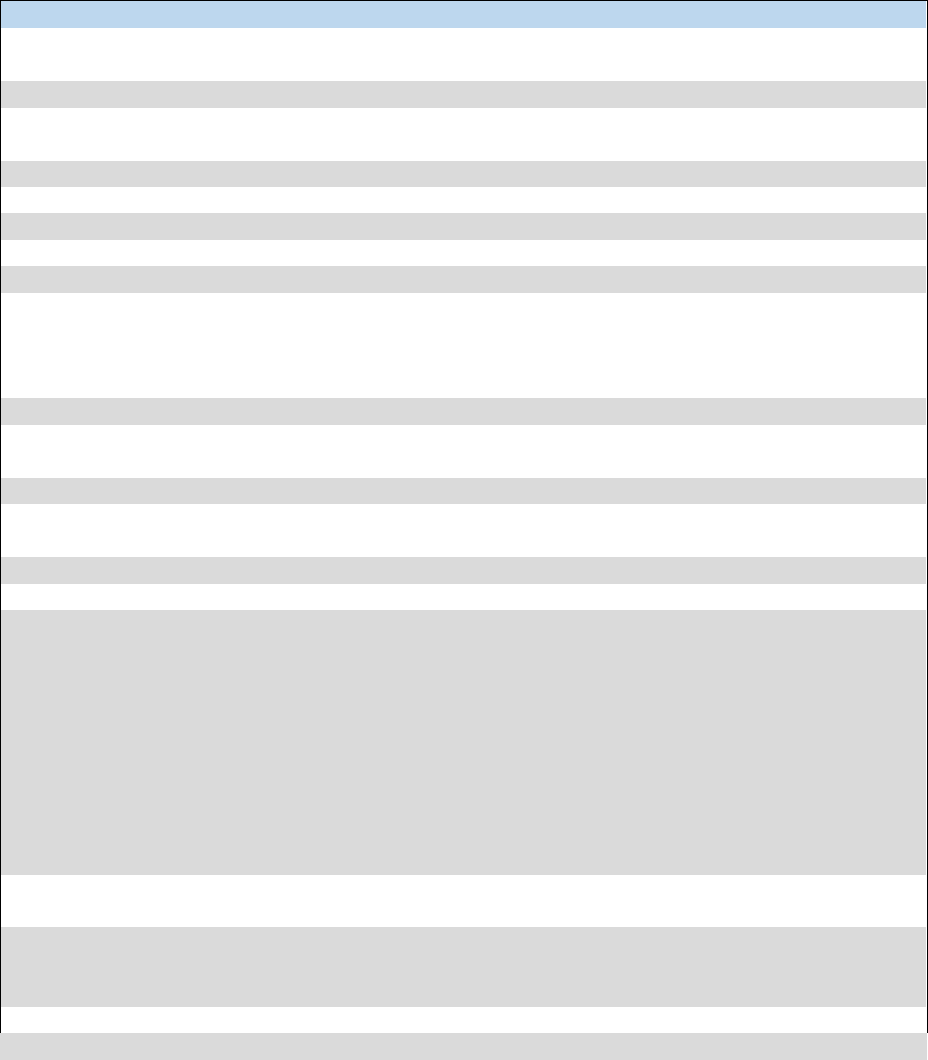

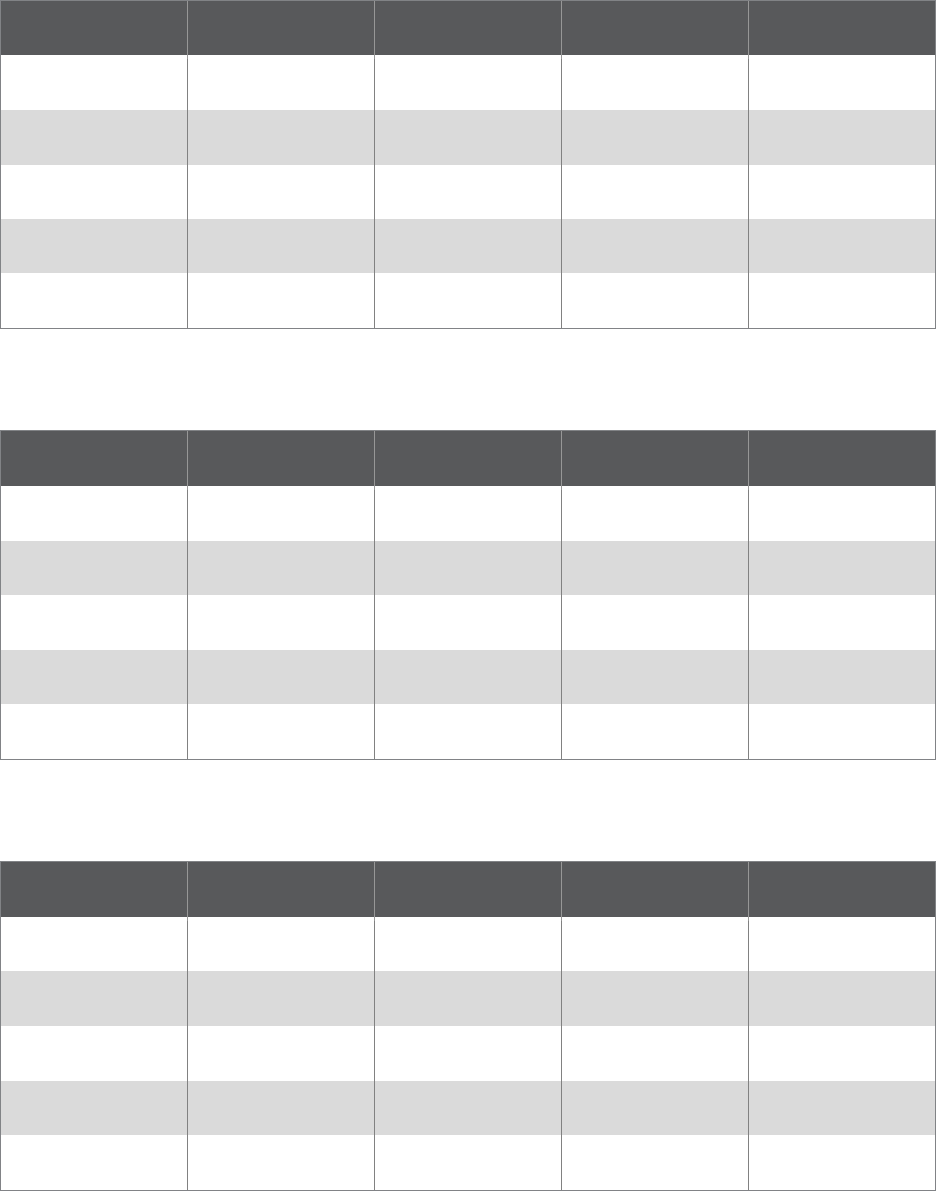

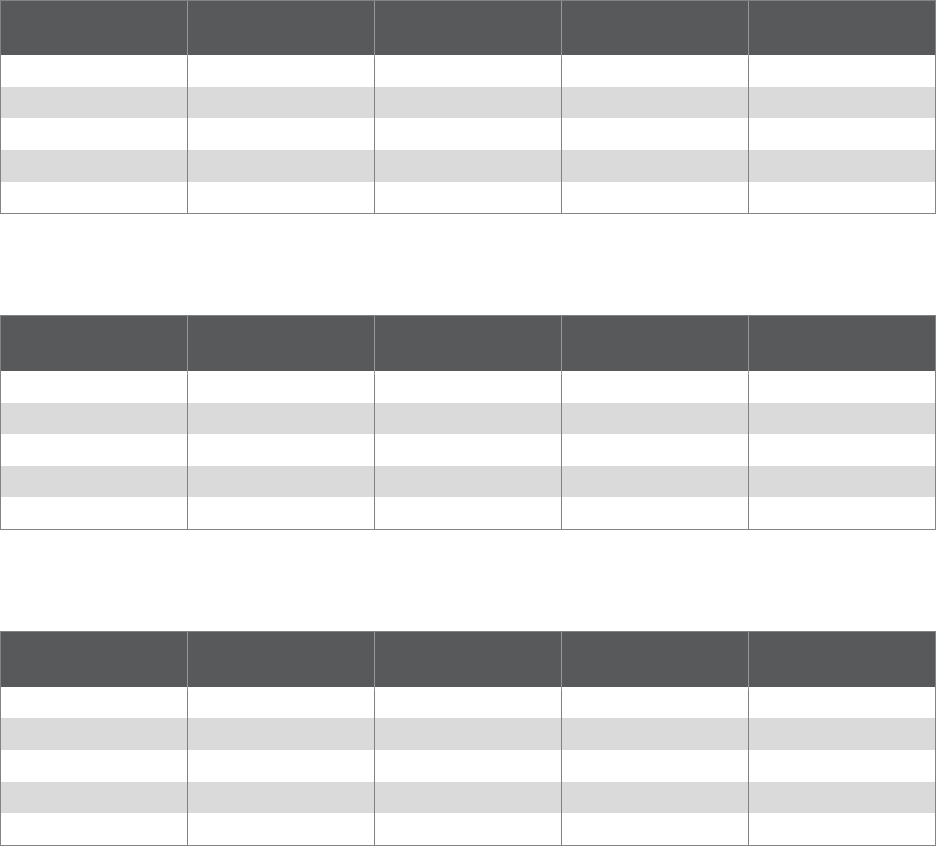

Appendix A: Responses by Question

Note: Due to the volume of individualized city responses, some response

s have been excluded from this

report. For detailed information, please contact Paul Aljets at paljets@orcities.org.

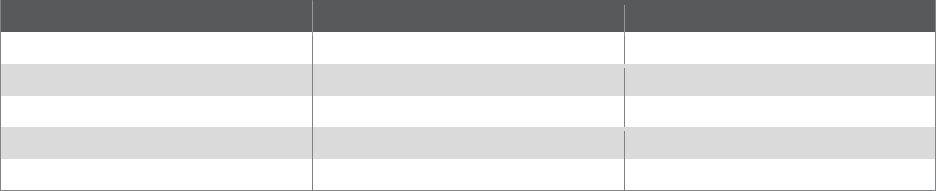

Q13. Are your telecom franchise agreements established by contract, city ordinance,

or other methods?

Contract

Ordinance

Other

#

%

#

%

#

%

21

23%

77

86%

9

10%

Q13. Other Responses

No Agreements

City Council Resolution

Ordinances for all individual franchise agreements still in effect, plus a 2008 ordinance establishing

licensing process for new and renewing franchises, with the exce

ption of Comcast cable due to

specific FCC regulations.

Written agreement w/charter advanced & charter fiberlink at 6%. In lieu of franchise at 5%

We have never made any telecom franchise agreements.

I don't know.

City Resolution if utility company agrees to sign city's standard franchise agreement without

modification.

No franchise agreements for telecom, Privilege Tax in Troutdale Municipal Code adopted by

ordinance.

Ordinances, resolutions and licenses

Q14. What is the Length of time of your telecom franchise agreements?

Common Responses

3 Years (2)

5 Years (8)

5 to 10 Years (2)

10 Years (29)

12 Years (1)

15 Years (4)

19 Years (1)

20 Years (8)

10 to 20 years (2)

15 to 20 years (1)

Open Ended (2)

Other Responses

20 (CenturyLink) and 6 (Wave)

5 years for CLEC and 10-20 years for ILEC

All of our providers follow our privilege tax ordinance and we do not have franchise agreements

Cal-Ore and Hunter-5 Years; and all others 10 years

League of Oregon Cities Franchise Agreement Survey Report

13

Q14. What is the Length of time of your telecom franchise agreements? (Cont’d)

Century Link - 5 years; Charter - 10 years; CoastCom - 5 years; Oregon Fast - 10 years; Alaska

Communications 5 years

CenturyLink - Annually, LSN - 10 years

CenturyTel - 20 years, CoastCom - 7 years

Currently extension agreement for one year; negotiating a new 10-year agreement

Depends on agreement- typically 7 years for new franchises, and 10 for renewals. Cenutrylink had 20

yr. agreement.

Frontier - 15 years and Sprint - 5 years

MINET - 10 YEARS; QWEST - 20 YEARS; US SPRINT 12 YEARS

No telecom franchise agreements in effect any longer. 5-year licenses are now granted to utility

operators per Ordinance 2008-2703.

Qwest 20; LS Networks and Astound 5 each

Q15. Does your city have any other form of compensation as a result of your telecom

franchises?

Yes

No

Unsure

#

%

#

%

#

%

13

15%

67

78%

6

7%

Q16. Please describe

Ability to request conduit in the build at marginal cost

City receives approximately $100,000 per year in franchise fees from the telecom franchises.

CoastCom provides service to City Hall at no charge.

Discount fiber rates in exchange for allowing equipment to be placed on towers.

Franchise fee and linear foot fee on ELI ($3 per foot) when greater than Franchise Fee.

Free Cable

Question is somewhat confusing in that we do receive a 5% privilege tax as outlined above. Not

sure what other intent is behind the question.

See franchise fees above.

The percentage as listed in the franchise. It is generally submitted quarterly from sales the franchise

provides to our community.

Use of a specified number of dark fiber strands.

We receive the 7% revenue

Q17. Does your city have a general business license fee/tax which telecom

providers must pay?

Yes

No

Unsure

#

%

#

%

#

%

13

15%

70

79%

6

7%

League of Oregon Cities Franchise Agreement Survey Report

14

Q18. How much revenue was generated from the general business license fee on telecom

providers for FY 2014-2015?

$15 (2)

$50 per year

$100

$200

$225

$300

$700

$ 110 (applies to CoastCom only)

Confidential

Less than $1,000

None

None, fee is waived for franchised utilities

Unsure of total, but the general business license fee is $100 a year.

Q19. What is the rate and methodology of the general business license fee?

$15 Annual Business License Fee

$50 flat annual rate for all businesses

$50 per year

$75/year each

$15 annual fee

2.2% of net

$50

Above Answered

Basic rate with variables depending on if office is in City Limits and how many employees

Employees located within the city limits

Fixed nominal fee based on number of employees

flat rate based on number of employees

Q20. Does the general business license fee offset the franchise fee or is it

required to pay both?

Fee offsets franchise fee

Both must be paid

Unsure

#

%

#

%

#

%

3

23%

9

69%

1

7%

Q21. Does your city charge a permit fee for operating in the right of way for telecom?

Yes

No

Unsure

#

%

#

%

#

%

15

17%

63

72%

9

10%

League of Oregon Cities Franchise Agreement Survey Report

15

Q21. Does your city's telecom franchise agreement waive permit fees for franchised

telecom providers?

Yes

No

Unsure

#

%

#

%

#

%

9

41%

11

50%

2

9%

Q18. How much permit fee revenue was collected from telecom providers for FY2014-2015?

300

$0 (3)

Less than $1,000 and not separately tracked in the financial system

Minimal

How many cell towers and/or antennas are located in the city?

0 (33)

1 (16)

2 (4)

3 (3)

4

4.5

5

6 (2)

7 (2)

10

12

14

17

18

27

34

37

900

This is something that we do not track. Unsure of the total number.

Q25. Is city property being used as a site for any telecom towers and/or antennas?

Yes

No

Unsure

#

%

#

%

#

%

30

36%

47

56%

7

8%

League of Oregon Cities Franchise Agreement Survey Report

16

Q26. What is the monthly lease rate?

$0 (3)

$750 (2)

$1,000

$1,100

$1,265.32

$1,400

$1,500

$1,900.15

$2,000

5,000

$1,600-$3,500

$1,860 and $2,337

$2,252/month

1,000 average

2 sites, $1,296 each, $2,592 total/mo.

Airport $1,043.82/ water $1,772.60, $788.66, $1,050.59, $2,585.80, $1,671.67, $2,185.45

Annual rental charge $1,500

depends on contract- between 1,300 and 1,800 pm

In 2012 it was $600 per month with an annual CPI adjustment based on 20 City ENR. Current Rate is

$669.10/month

Lease 1) Lease of city-owned property $992.13/month ($11,902.50 paid annually with 15% increase

every 5 years);Lease 2) Lease space on water tower $4,502.10/month (3% annual increase)Lease 3)

Lease space on water tower $3,434.67/month (3% annual increase)Lease 4) Lease space on water

tower $3,815.00/month (3% annual increase)NOTE: Water tower leases vary by number of antennas

and ground space rented.

Site 1 $997, Site 2 $532, Site 3 $1,069

Varies

Varies based on site current lease rates range from $1,000 to 2,050 per month.

Varies between $330 - $1,332 per month

Varies, but I believe only 2 City sites are being used. Leased at $150/per month.

Q27. Does your city charge for wireless attachments on utilit

y poles in the right of way?

Yes

No

Unsure

#

%

#

%

#

%

10

12%

60

70%

16

19%

League of Oregon Cities Franchise Agreement Survey Report

17

Please describe the amount and method of collection

(i.e. $500 per month, 5% of gross revenue, etc.)

$5,000 per attachment

$5,849.29 - $6,083.26 per year per site. Varies based on agreement.

$5.50 per pole per year for utilities, $25 per pole per year for private parties other than utilities. We

invoice for payment.

$50 per month

$7500/pole/year + annual accelerator of either CPI or flat percentage

5% or minimum fee

7% of gross

Currently we are not aware of any antennas on utility poles but if we were approached we would

treat these like a telecommunications franchise so minimum fee of $1,000 per quarter.

This has not been determined, but we will charged something.

We have not had any wireless attachments in the ROW but we intend to charge when they show

up. Method is currently undetermined.

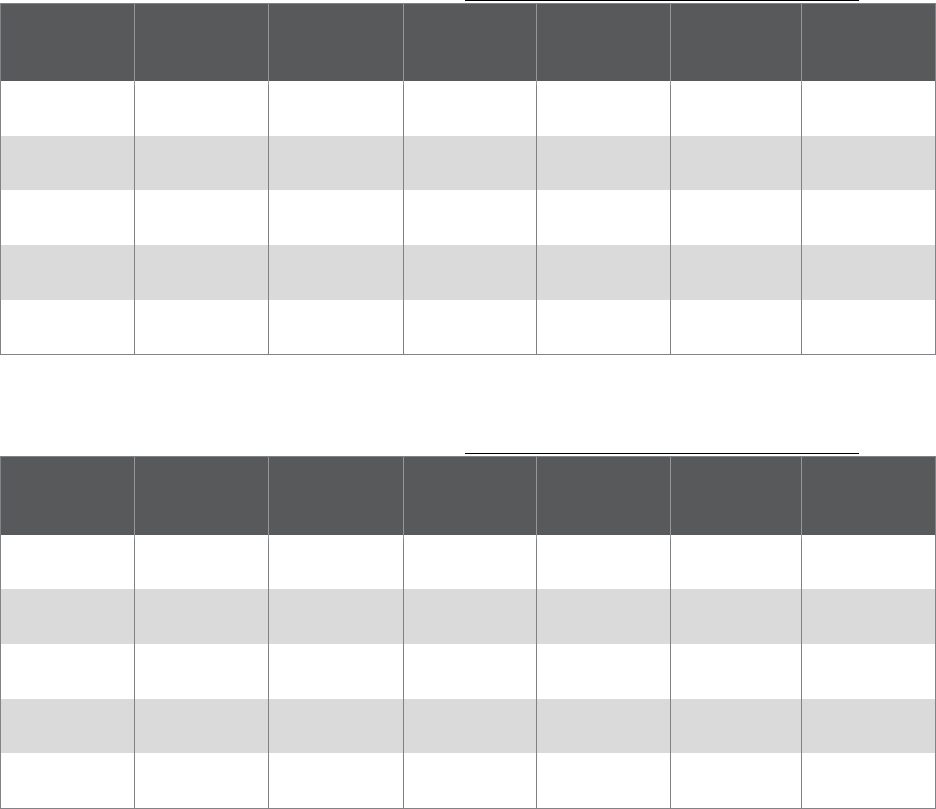

Q34. Are your cable franchise agreements established by contract, city ordinance

or other methods?

Contract

Ordinan

ce

Other

#

%

#

%

#

%

19

21%

60

67%

10

11%

Q34. Other Responses

Based on an IGA with the Mt. Hood Cable Regulatory Commission (MHCRC) handles all cable

franchise agreements, enforcement, and fee collection. The City receives a NET distribution each

year AFTER funding the MHCRC’s annual budget.

City Council Resolution (2)

Contract are negotiated by MACC and adopted by resolution or ordinance.

Mt. Hood Regulatory Commission by intergovernmental agreement bargains on our behalf, and

while adopt an ordinance with the franchise terms, all activities are through Mt. Hood Regulatory

Commission.

Negotiated by Metropolitan Area Cable Commission for Washington County cities - Council adopts

contract by ordinance.

No Agreements

-No Cable Company

No known cabl

e franchise companies in area

League of Oregon Cities Franchise Agreement Survey Report

18

Q14. What is the Length of time of your telecom franchise agreements?

Common Responses

5 Years (6)

8 Years

10 Years (36)

12 Years (3)

13 Years

15 Years (6)

20 Years

10 & 15 Years (2)

Other Responses

10 years Comcast and 15 years Frontier

5 years increment and is new and franchisee is setting up the process/system to be “able” to

provide such service. It will be at 7% of gross sales (minus federal taxes).

Auto Renewed

Same as Telecommunications

Existing agreement for Verizon is 15 years, 10 years for Comcast, and all other cable operators are

under the 5-year licensing structure.

Q36. Does your city provide Voice-over-Internet

-Protocol?

Yes

No

Unsure

#

%

#

%

#

%

23

31%

18

24%

34

45%

Q37. What is the annual revenue from VoIP?

$0 (6)

$70,041

$93,104

$116,050.47

$536,173.81 FY 2014

-15

This is included in their Gross Revenue calculation and is not separated out.

Included above under Telecom providers

Lumped in with cable franchise fees identified under MACC

Not listed Separately.

Not separated from cable/telecom

Nothing Yet, but they will have the capability in the near future. Franchise written as such.

Unknown (2)

Unsure from summary of revenues provided as subject to franchise fees?

VoIP revenue is captured through City’s utility license code and under code, specific revenue for

licensees is confidential.

Q38. Do the city cable franchise agreements include additional service provisions?

Yes

No

Unsure

#

%

#

%

#

%

32

42%

28

3

6%

17

22%

League of Oregon Cities Franchise Agreement Survey Report

19

Q39. Please list the additional services provided.

Funding for regional grant programs, funding for the regulatory commission, funding for local

access and locally originated programming all provided through the franchise agreements.

Service to public buildings, PEG channel.

$1 subscriber per month for PEG/INET capital support 5 PEG channels -- more available per

agreement but not being used 1 free limited basic drop to City facilities.

1 Basic Cable service at City facilities.

1% gross revenue PEG fees for capital equipment plus studio rent for local access station.

Access to one municipal building public access channel.

Additional public, education, and government access channels

community access channel

Community Access: HD channels, VoD, live video transport, 1% gross rev funds for capital costs

Community Grants: 1% gross rev funds for grants to nonprofits, local gov’t, schools, libraries to use

access channels and I-

Net: layer one transport services for 298 institutional sites thro

ughout

County; monthly fee paid to cable company on per site basis.

Educational and government access.

Free basic cable at multiple public facilities (City and School District), and there are also PEG fees

that cover PEG Broadcasting facility capital costs.

FREE DROP TO Library and schools

Government Access Channel. Complimentary service to government and schools (They want to

take both out during our current negotiations).

Include funding for PEG and provide channels to host PEG programing.

Local Information channel.

MetroEast, PCM, Comcast and the MHCRC worked together to implement ' a major technology

change to launch the initial two local channels in a high definition (HD) format, including the

channels which carry local government programs. The

new channels available to all cable

subscribers and is one of the first in the nation to have local community channels delivered in an

HD format. Funding for community grants providing critical technology funds for local schools,

libraries, nonprofits and local governments to use the Institutional Network (I-Net) and community

access channels to support their services, and I-Net fiber network capital construction

reimbursement. The MHCRC also provides capital funds to MetroEast Community Media to

upgrade the video capabilities at the. Gresham, Fairview and Troutdale city council chambers and

the Multnomah County Board

MINET: Emergency Alert System. PEG Channel. Live council feed. Basic service to City Hall, Police

Dept, Library PW, Amphitheater, WIMPEG He

ad-

End

PEG Access Support: PEG capital funding equal to 1.5% gross revenues from cable subscribers, PEG

channels as designated by franchise, provision of free public building installation and basic cable

services, use of interactive nodes (dark fiber) between designated public facilities.

PEG access, digital cable box deployment in government facilities, and a capital grant.

PEG channel

League of Oregon Cities Franchise Agreement Survey Report

20

Q39. Please list the additional services provided (Cont’d)

PEG Channel, service to public buildings, EAS capability

PEG fee .80 cents per subscriber paid quarterly. 4- PEG channels Free connection to City Buildings

PEG fees

PEG services through the Tualatin Valley Cable Television services (MACC) and public computer

network for 17 public agencies.

Public Access Channels, PEG (Public, Educational & Governmental) funding and access program

listings on digital channel guide, and Public Communications Network (PCN).

Public Education Channel

Reserve one local access (Public, Education, and Government) chann

el for the City. Provide an

emergency audio override capability to permit the City to transmit an emergency alert signal to all

subscribers. Provide one basic cable service to City Hall

Two non-discreet Public Education Government Access Channel. Installation to Public Facilities

with no installation fee or monthly service charge.

Q40. Does your city have a general business license fee/tax which cable providers must pay?

Yes

No

Unsure

#

%

#

%

#

%

10

13%

64

82%

4

5%

Q41. How much revenue was generated from the general business license fee on cable

providers for FY 2014-2015

$15

$50

$75

$300

Immaterial

Info is proprietary. For those services subject to franchise fees the business license tax due on those

services is offset against Franchise fees. However there could be other business lines (not subject

to franchise fees) that would be assessed for business license tax.

less than $1,000

No additional as providers are also telecom providers

roughly $200

Unsure Total

League of Oregon Cities Franchise Agreement Survey Report

21

Q42. What is the rate and methodology of the general business license fee?

$15 per year business license fee

$50 per year

flat rate

based on employees

$50 flat

2.2% of net income

per employee working in the city limits

$50 flat annual rate all businesses

Home office location and number of employees in Oregon City

Business License is $100 per year.

Q43. Does the general business license fee offset the franchise fee

or is it required to pay both?

Fee offsets franchise fee

Both must be paid

Unsure

#

%

#

%

#

%

0

0%

9

90%

1

10%

Q55. Does your city collect franchise fees from any other government entity?

Yes

No

Unsure

#

%

#

%

#

%

10

11%

74

85%

3

3%

Q56. Does your city charge franchise fees to itself?

Yes

No

Unsure

#

%

#

%

#

%

31

36%

53

62%

2

2%

Q46. Does your city pay franchise fees to other government entities?

Yes

No

Unsure

#

%

#

%

#

%

1

1%

83

95%

3

3%

League of Oregon Cities Franchise Agreement Survey Report

22

Appendix B: Survey

Utility & Franchise Fee Survey 2015

Q1 City Name:

Q2 Name of responding person:

Q3 Title of responding person:

Q4 Email Address of responding person:

Q5 In order to accurately analyze and report on your city's utility and franchise fees, four (4) years of

data on telecommunication and cable television franchises is requested. In the following survey, the

League asks questions related to:

-Telecommunications Providers

-Cable Television/Video Providers

-Government Franchise Agreements (In-Lieu-Of Franchises)

-Other Franchises (such as electric, natural gas, solid waste, water and wastewater)

Telecommunication Companies

Terms & Definitions

-ILEC: (Incumbent Local Exchange Carrier) Primary provider of local phone service. Examples:

Qwest,

Sprint, Verizon, and Centurytel

-CLEC: (Competitive Local Exchange Carrier) Alternative provider competing with ILECs. Examples:

ATG and ELI

-Long Haul Carrie: Provider who has facilities in city’s right of way, but does not provide services to

residence. Usually charged a per foot fee.

Q7 Please list the telecommunication companies contracted with the city as well as the type of provider

(ILEC, CLEC, Long Haul Carrier, Other).

Company Name (1)

Type of Provider (2)

Company 1 (1)

Company 2 (2)

Company 3 (3)

Company 4 (4)

Company 5 (5)

League of Oregon Cities Franchise Agreement Survey Report

23

Q8 Please list any telecom franchise fees, privilege taxes, and/or per foot fees as well as the revenue

generated by these taxes and fees for FY2011-2012. Please list in the same order as in Question 7

.

Franchise

Fee Rate (%)

(1)

Franchise

Fee Revenue

($) (2)

Privilege Tax

Rate (%) (3)

Privilege Tax

Revenue ($)

(4)

Per Foot Fee

Rate (%) (5)

Per Foot Fee

Revenue ($)

(6)

Company 1

(1)

Company 2

(2)

Company 3

(3)

Company 4

(4)

Company 5

(5)

Q10 Please list any telecom franchise fees, privilege taxes, and/or per foot fees as well as the revenue

generated by these taxes and fees for FY2012-2013. Please list in the same order as in Question 7.

Franchise

Fee Rate (%)

(1)

Franchise

Fee Revenue

($) (2)

Privilege Tax

Rate (%) (3)

Privilege Tax

Revenue ($)

(4)

Per Foot Fee

Rate (%) (5)

Per Foot Fee

Revenue ($)

(6)

Company 1

(1)

Company 2

(2)

Company 3

(3)

Company 4

(4)

Company 5

(5)

League of Oregon Cities Franchise Agreement Survey Report

24

Q11 Please list any telecom franchise fees, privilege taxes, and/or per foot fees as well as the revenue

generated by these taxes and fees for FY2013-2014. Please list in the same order as in Question 7

.

Franchise

Fee Rate (%)

(1)

Franchise

Fee Revenue

($) (2)

Privilege Tax

Rate (%) (3)

Privilege Tax

Revenue ($)

(4)

Per Foot Fee

Rate (%) (5)

Per Foot Fee

Revenue ($)

(6)

Company 1

(1)

Company 2

(2)

Company 3

(3)

Company 4

(4)

Company 5

(5)

Q12 Please list any telecom franchise fees, privilege taxes, and/or per foot fees as well as the revenue

generated by these taxes and fees for FY2014-2015. Please list in the same order as in Question 7.

<span style="font-

size:13px;">Franchise

Fee Rate (%)</span>

(1)

Franchise

Fee

Revenue ($)

(2)

Privilege

Tax Rate

(%) (3)

Privilege

Tax

Revenue ($)

(4)

Per Foot

Fee Rate

(%) (5)

Per Foot

Fee

Revenue ($)

(6)

Company 1

(1)

Company 2

(2)

Company 3

(3)

Company 4

(4)

Company 5

(5)

Q13 Are your telecom franchise agreements established by contract, city ordinance, or other methods?

(Check all that apply)

Contract (1)

City Ordinance (2)

Other (Please Describe) (3) ____________________

Q14 What is the Length of time of your telecom franchise agreements? (Please answer in years)

League of Oregon Cities Franchise Agreement Survey Report

25

Q15 Does your city receive any form of compensation as a results of your telecom franchises?

Yes (1)

No (2)

Unsure (3)

Answer If Does your city receive any form of compensation as a results of your franchises? Yes Is

Selected

Q16 Please describe

Q17 Does your city have a general business license fee/tax which telecom providers must pay?

Yes (1)

No (2)

Unsure (3)

Answer If Does your city have a general business license fee/tax which telecom providers must pay? Yes

Is Selected

Q18 How much revenue was generated from the general business license fee on telecom providers for FY

2014-2015?

Answer If Does your city have a general business license fee/tax which telecom providers must pay? Yes

Is Selected

Q19 What is the rate and methodology of the general business license fee?

Answer If Does your city have a general business license fee/tax which telecom providers must pay? Yes

Is Selected

Q20 Does the general business license fee offset the franchise fee or is the provider required to pay both?

License fee offsets franchise fee (1)

Both must be paid (2)

Unsure (3)

Q21 Does your city charge a permit fee for operating in the right of way for telecom?

Yes (1)

No (2)

Unsure (3)

Answer If Does your city charge a permit fee for operating in the right of way? Yes Is Selected

Q22 Does your city’s telecom franchise agreement waive permit fees for franchised telecom providers?

Yes (1)

No (2)

Unsure (3)

Answer If Does your city’s telecom franchise agreement waive permit fees for franchised telecom

providers? No Is Selected

Q23 How much permit fee revenue was collected from telecom providers in FY 2014-2015?

Q24 How many cell towers and/or antennas are located in the city?

League of Oregon Cities Franchise Agreement Survey Report

26

Q25 Is city property being used as a site for any of these telecom towers and/or antennas?

Yes (1)

No (2)

Unsure (3)

Answer If Is city property being used as a site for any of these telecom towers and/or antennas? Yes Is

Selected

Q26 What is the monthly lease rate?

Q27 Does your city charge for wireless attachments on utility poles in the right of way?

Yes (1)

No (2)

Unsure (3)

Answer If Does your city charge for wireless attachments on utility poles in the right of way? Yes Is

Selected

Q28 Please describe the amount and method of collection (i.e. $500 per month, 5% of gross revenue, etc.)

Cable Television/ Video Franchises

Q30 Please list any Cable TV/Video Provider franchise fees and/or privilege taxes as well as the

revenues generated by these taxes and fees for FY2011-2012.

Franchise Fee Rate

(%) (1)

Franchise Fee

Revenue ($) (2)

Privilege Tax Rate

(%) (3)

Privilege Tax

Revenue ($) (4)

Cable Company 1

(1)

Cable Company 2

(2)

Cable Company 3

(3)

Cable Company 4

(4)

Cable Company 5

(5)

League of Oregon Cities Franchise Agreement Survey Report

27

Q31 Please list any Cable TV/Video Provider franchise fees and/or privilege taxes as well as the

revenue generated by these taxes and fees for FY2012-2013.

Franchise Fee Rate

(%) (1)

Franchise Fee

Revenue ($) (2)

Privilege Tax Rate

(%) (3)

Privilege Tax

Revenue ($) (4)

Cable Company 1

(1)

Cable Company 2

(2)

Cable Company 3

(3)

Cable Company 4

(4)

Cable Company 5

(5)

Q32 Please list any

Cable TV/Video Provider

franchise fees

and/or privilege taxes as well as the

revenue generated by these taxes and fees for FY2013-2014.

Franchise Fee Rate

(%) (1)

Franchise Fee

Revenue ($) (2)

Privilege Tax Rate

(%) (3)

Privilege Tax

Revenue ($) (4)

Cable Company 1

(1)

Cable Company 2

(2)

Cable Company 3

(3)

Cable Company 4

(4)

Cable Company 5

(5)

Q33 Please list any Cable TV/Video Provider franchise fees and/or privilege taxes as well as the

revenue generated by these taxes and fees for FY2014-2015.

Franchise Fee Rate

(%) (1)

Franchise Fee

Revenue ($) (2)

Privilege Tax Rate

(%) (3)

Privilege Tax

Revenue ($) (4)

Cable Company 1

(1)

Cable Company 2

(2)

Cable Company 3

(3)

Cable Company 4

(4)

Cable Company 5

(5)

League of Oregon Cities Franchise Agreement Survey Report

28

Q34 Are your cable franchise agreements established by contract, city ordinance, or other methods?

(Check all that apply)

Contract (1)

Ordinance (2)

Other (Please Describe) (3) ____________________

Q35 What is the Length of time of your cable franchise agreements? (Please answer in years)

Q36 Does your city cable provider provide Voice-Over-Internet-Protocol (VoIP)?

Yes (1)

No (2)

Unsure (3)

Answer If Does your city cable provider provide Voice-Over-Internet-Protocol (VoIP)? Yes Is Selected

Q37 What is the annual revenue from VoIP?

Q38 Do the city cable franchise agreements include additional service provisions? (i.e. community access

provisions)

Yes (1)

No (2)

Unsure (3)

Answer If Do the city cable franchise agreements include additional service provisions? (i.e. community

acc...

Yes Is Selected

Q39 Please list the additional services provided.

Q40 Does your city have a general business license fee/tax which cable providers must pay?

Yes (1)

No (2)

Unsure (3)

Answer If Does your city have a general business license fee/tax which

telecom providers must pay? Yes

Is Selected

Q41 How much revenue was generated from the general business license fee on cable providers for FY

2014-2015?

Answer If Does your city have a general business license fee/tax which telecom providers must pay? Yes

Is Selected

Q42 What is the rate and methodology of the general business license fee?

Answer If Does your city have a general business license fee/tax which telecom providers must pay? Yes

Is Selected

Q43 Does the general business license fee offset the franchise fee or is the provider required to pay both?

License fee offsets franchise fee (1)

Both must be paid (2)

Unsure (3)

League of Oregon Cities Franchise Agreement Survey Report

29

Government Franchise Fees

(In-Lieu-of Franchise Fees)

Q55 Does your city collect franchise fees from any other government en

tity?

Yes (1)

No (2)

Unsure (3)

Answer If Does your city collect franchise fees from any other government entity? Yes Is Selected

Q45 Please list any Government fees, as well as the revenue generated by these fees for FY2014-2015.

Franchise Fee Rate (%) (1)

Franchise Fee Revenue ($) (2)

Telecommunication (1)

Cable (2)

Water (3)

Wastewater (4)

Electric (5)

Other (Please Specify) (6)

Q56 Does your city charge franchise fees to itself?

Yes (1)

No (2)

Unsure (3)

Answer If Does your city charge franchise fees to itself? Yes Is Selected

Q57 Please list any fees the city charges itself (in-lieu-of fees), as well as the revenue generated by these

fees for FY2014-2015.

Franchise Fee Rate (%) (1)

Franchise Fee Revenue ($) (2)

Telecommunication (1)

Cable (2)

Water (3)

Wastewater (4)

Electric (5)

Other (Please Specify) (6)

Q46 Does your city pay franchise fees to other government entities?

Yes (1)

No (2)

Unsure (3)

League of Oregon Cities Franchise Agreement Survey Report

30

Answer If Does your city pay franchise fees to other government entities? Yes Is Selected

Q58 Please list any fees paid to other government entities, as well as the expenses accrued by these fees

for FY2014-2015.

Name of Government (1)

Franchise Fee Rate (%)

(2)

Franchise Fee

Expenditure ($) (3)

Telecommunication (1)

Cable (2)

Water (3)

Wastewater (4)

Electric (5)

Other (Please Specify (6)

Other Franchises

Q48 Please list any Electric Provider franchise fees and/or privilege taxes as well as the revenue

generated by these taxes and fees for FY2014-2015.

Franchise Fee Rate

(%) (1)

Franchise Fee

Revenue ($) (2)

Privilege Tax Rate

(%) (3)

Privilege Tax

Revenue ($) (4)

Company 1 (1)

Company 2 (2)

Company 3 (3)

Company 4 (4)

Company 5 (5)

Q49 Please list any Natural Gas Provider franchise fees and/or privilege taxes as well as the revenue

generated by these taxes and fees for FY2014-2015.

Franchise Fee Rate

(%) (1)

Franchise Fee

Revenue ($) (2)

Privilege Tax Rate

(%) (3)

Privilege Tax

Revenue ($) (4)

Company 1 (1)

Company 2 (2)

Company 3 (3)

Company 4 (4)

Company 5 (5)

Q50 Please list any Solid Waste Provider franchise fees and/or privilege taxes as well as the revenue

generated by these taxes and fees for FY2014-2015.

Franchise Fee Rate

(%) (1)

Franchise Fee

Revenue ($) (2)

Privilege Tax Rate

(%) (3)

Privilege Tax

Revenue ($) (4)

Company 1 (1)

Company 2 (2)

Company 3 (3)

Company 4 (4)

Company 5 (5)

League of Oregon Cities Franchise Agreement Survey Report

31

Q51 Please list any Water Provider franchise fees and/or privilege taxes as well as the revenue generated

by these taxes and fees for FY2014-2015.

Franchise Fee Rate

(%) (1)

Franchise Fee

Revenue ($) (2)

Privilege Tax Rate

(%) (3)

Privilege Tax

Revenue ($) (4)

Company 1 (1)

Company 2 (2)

Company 3 (3)

Company 4 (4)

Company 5 (5)

Q52 Please list any Wastewater Provider franchise fees and/or privilege taxes as well as the revenue

generated by these taxes and fees for FY2014-2015.

Franchise Fee Rate

(%) (1)

Franchise Fee

Revenue ($) (2)

Privilege Tax Rate

(%) (3)

Privilege Tax

Revenue ($) (4)

Company 1 (1)

Company 2 (2)

Company 3 (3)

Company 4 (4)

Company 5 (5)

Q53 Please list any Other Provider franchise fees and/or privilege taxes as well as the revenue generated

by these taxes and fees for FY2014-2015.

Franchise Fee Rate

(%) (1)

Franchise Fee

Revenue ($) (2)

Privilege Tax Rate

(%) (3)

Privilege Tax

Revenue ($) (4)

Company 1 (1)

Company 2 (2)

Company 3 (3)

Company 4 (4)

Company 5 (5)

Q54 Additional Comments?