2019 benets at a glance

independence choice

WORKFORCE OPTIMIZATION

®

Benefits at a glance .......................................................................1

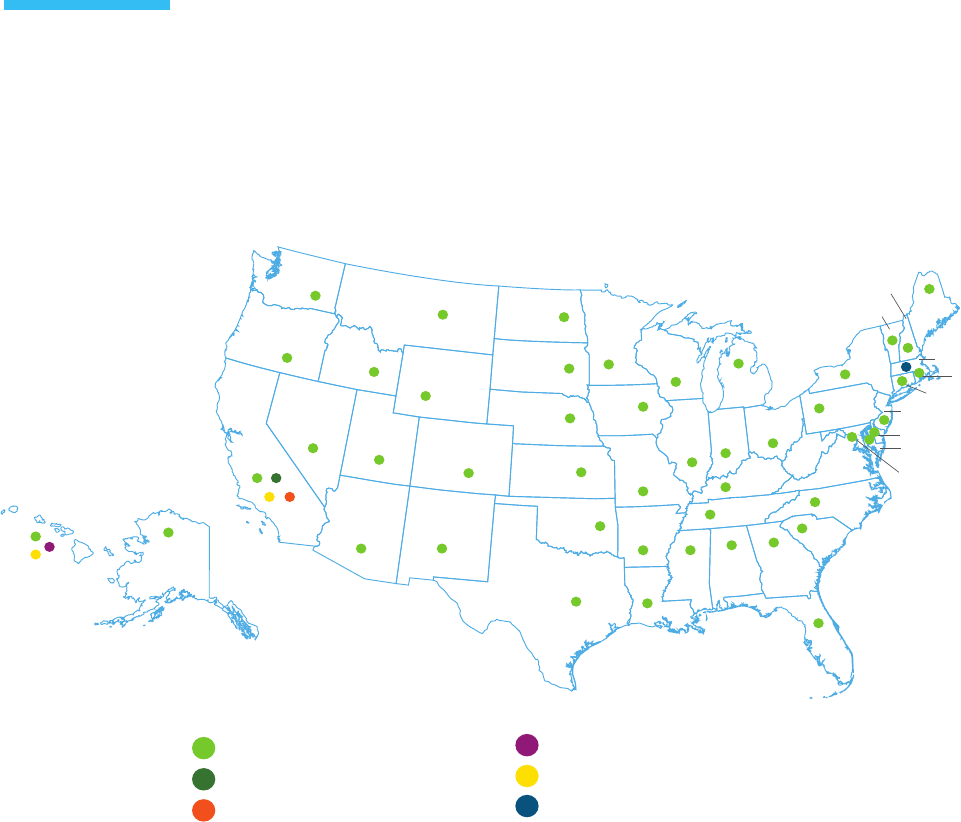

Medical coverage map ....................................................................3

Medical coverage terms ...................................................................4

Medical coverage options .................................................................6

Dental benefits at a glance ................................................................8

Vision benefits at a glance .................................................................9

This brochure provides an overview of your Insperity benefits package. Actual benefits are subject to the provisions and

limitations of the agreements between Insperity and its benefits providers. Detailed benefits information is available on the

Insperity Premier

™

platform at portal.insperity.com.

Except where otherwise indicated, employees must be generally working 30 or more hours per week, on average (20 hours

per week in Hawaii), or meet the requirements for continuing eligibility during an approved leave of absence, to be eligible

for the health and welfare benefits in this package. Certain individuals are excluded from participation in Insperity Plans.

Please refer to the Summary Plan Description (SPD) for each Plan on Insperity Premier for full eligibility requirements.

portal.insperity.com 1 866.715.3552

The following benefits are available to full-time (or full-time equivalent) Insperity employees that generally work 30 or more

hours per week (20 or more hours in Hawaii) on average, and meet all other eligibility requirements:

The Insperity Group Health Plan

Medical coverage options include prescription coverage and vary by insurance carrier, region and coverage type.

All coverage options also generally include wellness programs and telemedicine options (where permied by state law).

Availability is determined by benefits package and ZIP code service area. Dental and vision coverage is available through

UnitedHealthcare Dental and Vision Service Plan nationwide, and may be elected independently of medical coverage.

The Insperity Health Care Flexible Spending Account (FSA) Plan

Make pretax contributions (if eligible) up to the annual maximum through payroll deduction for qualifying health care

expenses incurred during the plan year.

The Insperity Health Savings Account (HSA) Program

If enrolled in an Insperity High Deductible Health Plan (HDHP) option, make contributions by payroll deduction on a pretax

basis (if eligible) or on a post-tax basis up to established annual federal limits for qualifying health care expenses.

The Insperity Welfare Benefits Plan

Benefits include employer-paid basic term life and personal accident insurance equal to 1 x covered annual earnings

($50,000 maximum). Disability coverage for up to 60% of covered weekly or monthly earnings is available to you as a

voluntary (employee-paid) benefit. Voluntary life and personal accident insurance is also available to you and your eligible

dependents. See the Voluntary Benefits Book for coverage amounts and rates.

The Insperity Adoption Assistance Program

Reimburses up to $1,500 of qualifying expenses per qualified adoption. Requires 180 days of continuous service aer

obtaining eligible status.

Benets at a glance

Life, Personal Accident and Disability Coverage Amounts

Coverage amounts for benefits are determined by your covered annual earnings, which include base or estimated

annual earnings plus amounts received as commissions, piece work and fee-based pay as paid by Insperity.

2

The following benefits are available to all Insperity employees, whether full-time, part-time or seasonal:

The Insperity Employee Assistance Program

A counseling and consultation service available to all employees (and their dependents) with no hourly eligibility

requirement. Most services are available at no cost.

The Insperity Commuter Benefits Program

Pay for job-related mass transit and/or parking expenses with pretax dollars (if eligible).

Learning and Development

Self-paced online, live virtual and classroom training programs to learn new skills, maintain safety and compliance, improve

performance and develop careers.

Insperity Pay Options

Payroll direct deposit and debit pay card options are available.

MarketPlace

™

Offers online discounts on a variety of goods and services, including identity the protection, pet health insurance, travel,

electronics, gis, household needs and more.

Benets at a glance

WA

OR

CA

NV

UT

AZ NM

CO

WY

SD

NE

KS

OK

TX

AK

HI

ID

MT

ND

MN

MI

IN

OH

WV

VA

PA

NY

VT

NH

ME

MA

RI

CT

NJ

DE

MD

DC

WI

IL

IA

MO

KY

TN

MS

AL

GA

SC

NC

FL

AR

LA

Tus

Kaiser Permanente

HMSA BlueCross BlueShield of Hawaii

UnitedHealthcare

UnitedHealthcare of California

Blue Shield of California

portal.insperity.com 3 866.715.3552

To participate in a coverage option, an eligible employee must live in a ZIP code service area included in that insurance

carrier’s network. ZIP codes associated with an insurance carrier’s network service area are determined by the insurance

carrier (not Insperity) and are specific to the health insurance product offerings defined in the carrier’s contract

with Insperity.

Where offered, an indemnity (out-of-area) option is available to employees who live in a ZIP code service area not served by

any Insperity insurance carrier’s network.

The Insperity Group Health Plan medical coverage options available to an eligible employee are determined by:

• The Insperity benefits package selected by the client company,

• The employee’s residential ZIP code service area, and

• The insurance carrier(s) and networks available in that area.

Medical coverage map

portal.insperity.com 4 866.715.3552

Calendar-year deductible

This is the amount owed for certain covered health care services before the plan begins to pay benefits. Not all covered

services require this deductible to be met (e.g., office visit copays under non-HDHP coverage options).

Except as otherwise noted for certain HDHP-type coverage options, Insperity coverage options generally have

“embedded” calendar-year deductibles and out-of-pocket maximums (OOPMs). For family coverage under the embedded

design, each covered family member needs to satisfy only an individual calendar-year deductible (not the entire family

deductible), before the individual member can receive covered medical services or prescription drugs at copay or

coinsurance levels. Individual family members are responsible for their own out-of-pocket covered medical expenses up to

the individual-level OOPM. Combined individual out-of-pocket covered medical expenses for a family will never exceed the

family-level OOPM.

Certain Insperity HDHP coverage options have “aggregate” (non-embedded) deductibles and OOPMs. For family coverage

under the aggregate design, the entire family calendar-year deductible must be met before copays or coinsurance will

apply for any individual family member. Only aer the full family deductible is met will any family member be able to receive

covered medical services or prescription drugs at copay or coinsurance levels. A family is responsible for all its members’

out-of-pocket covered medical expenses up to the family-level OOPM.

All Insperity coverage options cover in-network physician office visits for preventive care services (as defined in the

applicable Certificate of Coverage) at 100% with no copay or coinsurance, regardless of whether any deductible has

been met.

Annual out-of-pocket maximum (OOPM)

This is the most a participant must pay out of their own pocket during the calendar year before the plan begins to pay 100%

of eligible expenses. Medical calendar-year deductibles, copays and coinsurance (including prescriptions, unless otherwise

noted) generally apply toward satisfying the annual out-of-pocket maximum. Insperity coverage options with embedded

deductibles will have embedded OOPMs; HDHP coverage options with aggregate deductibles will have aggregate OOPMs.

Medical coverage terms

portal.insperity.com 5 866.715.3552

Copays

A fixed amount you pay for a covered service from an in-network provider. Generally, whenever a medical copay applies,

coinsurance will not apply, and you are not required to first satisfy any applicable medical calendar-year deductible.

Coinsurance

This is your share of the cost of a covered service, calculated as a percent of the allowed amount for the service. Coinsurance

(where applicable) applies aer the participant satisfies any applicable calendar-year deductible. Also, coinsurance generally

will not apply where a copay applies.

In-network

Providers and facilities that contract with your health insurance carrier are considered in-network; you will pay in-network

copays, deductibles and coinsurance rates for eligible expenses from network providers.

Out-of-network

Providers and facilities that do not contract with your health insurance carrier are considered out-of-network.

If your coverage option does not include out-of-network coverage, no benefits will be paid for services received from

out-of-network providers, except for emergency medical treatment.

If your elected coverage option pays benefits for services received from out-of-network providers, your financial

responsibility will likely be much greater. It is important to understand how your specific insurance carrier reimburses for

out-of-network services, and it is your responsibility to pay any cost difference between what the out-of-network provider

charges and what the plan covers (i.e., what the insurance carrier pays). In addition, the cost difference, which could be

substantial depending on the cost of the care received, does not apply to the out-of-pocket maximum.

The plan year for the Insperity Group Health Plan is the calendar year.

Plan design changes take effect each Jan. 1, and may include increases to out-of-pocket costs such as copays,

coinsurance, annual deductibles and annual out-of-pocket maximums. Coverage periods under the Plan will

last 12 months, and will vary by client company based on the renewal date of the client company’s contract

with Insperity.

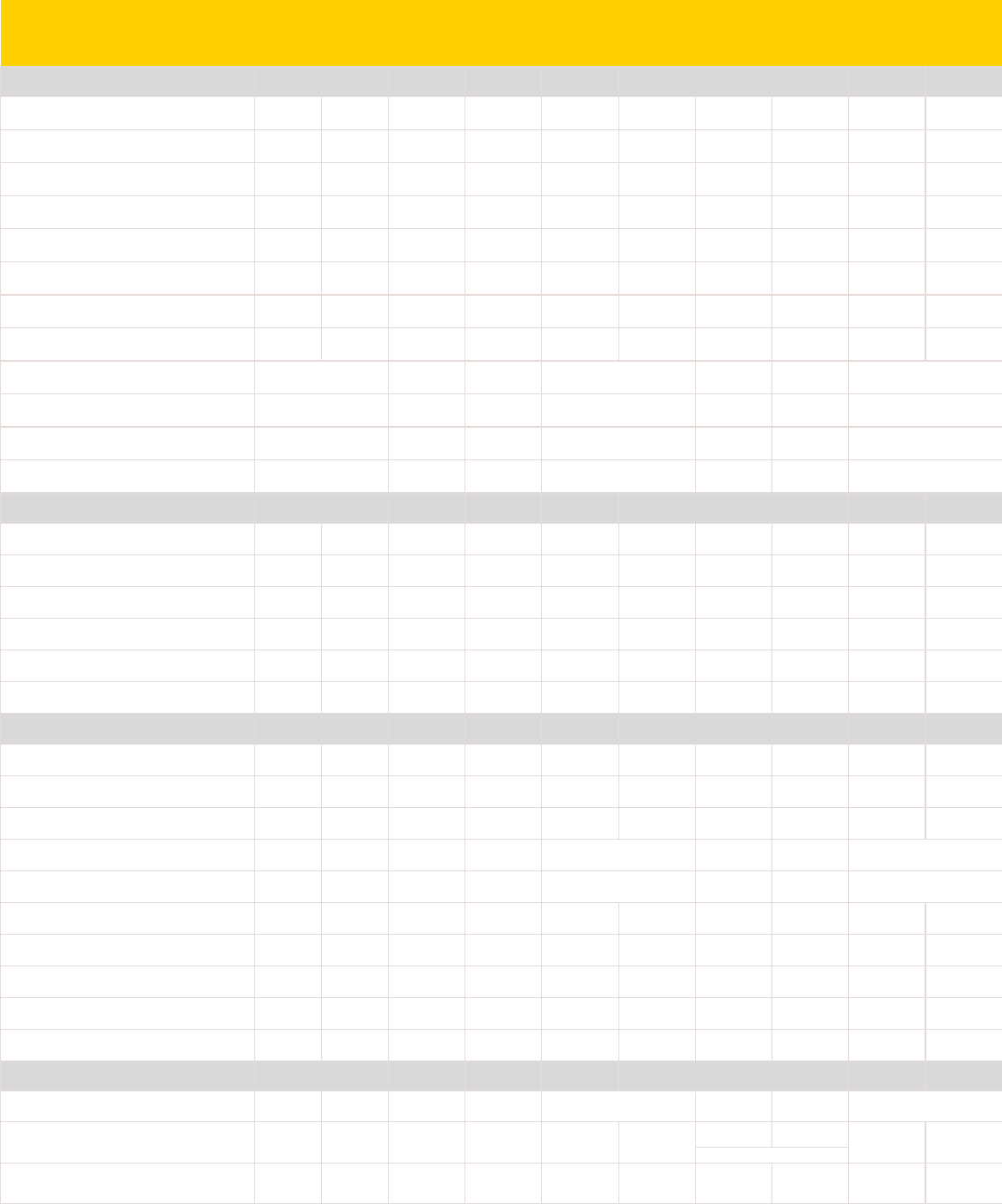

coverage options

by state physician specialist telemedicine outpatient

surgery

inpatient

hospital

urgent care

clinic

emergency

room

National

in-network

out-of-

network

in-network

individual

in-network

family

out-of-network

individual

out-of-network

family

in-network

individual

in-network

family

out-of-network

individual

out-of-network

family

office visit office visit virtual visit OPS IPH UC ER individual family tier 1 tier 2 tier 3 tier 4

UnitedHealthcare Choice Plus 500/80 80% 60% $500 $1,500 $1,000 $3,000 $5,000 $10,000 $10,000 $20,000 $35 $60 $20 20% 20% $75 $250 $100 $300 $10 $35 $60 $120

UnitedHealthcare Choice Plus 1000 80% 60% $1,000 $3,000 $2,000 $6,000 $4,500 $9,000 $9,000 $18,000 $35 $60 $20 20% 20% $75 $250 $100 $300 $10 $35 $60 $120

UnitedHealthcare Choice Plus 1500 80% 60% $1,500 $4,500 $3,000 $9,000 $6,350 $12,700 $12,700 $25,400 $35 $60 $20 20% 20% $75 $250 $100 $300 $10 $35 $60 $120

UnitedHealthcare Choice Plus 2500 70% 50% $2,500 $7,500 $5,000 $15,000 $6,850 $13,700 $13,700 $27,400 $40 $70 $20 30% 30% $75 $250 $100 $300 $10 $35 $60 $120

UnitedHealthcare Choice Plus 6000 100% 70% $6,000 $13,200 $12,000 $16,400 $7,000 $14,000 $14,000 $28,000 $40 $70 $20 0% 0% $75 $500 $200 $600 $10 $35 $60 $120

UnitedHealthcare Choice Plus HDHP 1500

aggregate deductible option

90% 70% $1,500 $3,000 $3,000 $6,000 $4,000 $7,350 $8,000 $14,700 10% 10% 10% 10% 10% 10% 10% $10 $35 $60 $120

UnitedHealthcare Choice Plus HDHP 3000 90% 70% $3,000 $6,000 $6,000 $12,000 $6,650 $13,300 $13,300 $26,600 10% 10% 10% 10% 10% 10% 10% $10 $35 $60 $120

UnitedHealthcare Choice Plus HDHP 5000 80% 60% $5,000 $10,000 $10,000 $20,000 $6,650 $13,300 $13,300 $26,600 20% 20% 20% 20% 20% 20% 20% $10 $35 $60 $120

UnitedHealthcare Out-of-Area 500 $500 $1,500 $6,350 $12,700 20% 20% $20 20% 20% 20% 20% $100 $300 $10 $35 $60 $120

UnitedHealthcare Out-of-Area HDHP 1500

aggregate deductible option

$1,500 $3,000 $4,000 $7,350 20% 20% 20% 20% 20% 20% 20% $10 $35 $60 $120

UnitedHealthcare Out-of-Area HDHP 3000 $3,000 $6,000 $6,650 $13,300 20% 20% 20% 20% 20% 20% 20% $10 $35 $60 $120

UnitedHealthcare Out-of-Area HDHP 5000 $5,000 $10,000 $6,650 $13,300 20% 20% 20% 20% 20% 20% 20% $10 $35 $60 $120

California

(choose national or regional options)

in-network

out-of-

network

in-network

individual

in-network

family

out-of-network

individual

out-of-network

family

in-network

individual

in-network

family

out-of-network

individual

out-of-network

family

office visit office visit virtual visit OPS IPH UC ER individual family tier 1 tier 2 tier 3 tier 4

UnitedHealthcare of California HMO 100% n/a n/a n/a n/a n/a $3,000 $6,000 n/a n/a $25 $50 $25 $125 $500 $25 $200 n/a n/a $10 $30 $50

specialty rx

30% max

$200

Blue Shield of California HMO 100% n/a n/a n/a n/a n/a $3,000 $6,000 n/a n/a $25 $50 $5 $150 $500 $25 $200 n/a n/a $10 $25 $40

specialty rx

30% max

$200

Blue Shield of California Deductible HMO 1000 90% n/a $1,000 $2,000 n/a n/a $6,050 $12,100 n/a n/a $35 $50 $5 10% 10% $35 10% $10 $30 n/a

specialty rx

30% max

$200

Kaiser Permanente HMO 100% n/a n/a n/a n/a n/a $3,000 $6,000 n/a n/a $25 $50 $0 $100 $250 $25 $200 n/a n/a $10 $30 n/a

specialty rx

30% max

$150

Kaiser Permanente Deductible HMO 1000 70% n/a $1,000 $2,000 n/a n/a $6,050 $12,100 n/a n/a $35 $50 $0 30% 30% $35 30% $10 $30 n/a

specialty rx

30% max

$150

Kaiser Permanente HMO HDHP 90% n/a $2,700 $5,400 n/a n/a $5,200 $10,400 n/a n/a 10% 10% 0% 10% 10% 10% 10% $10 $30 n/a

specialty rx

30% max

$150

Massachusetts

(choose regional options only)

in-network

out-of-

network

in-network

individual

in-network

family

out-of-network

individual

out-of-network

family

in-network

individual

in-network

family

out-of-network

individual

out-of-network

family

office visit office visit virtual visit OPS IPH UC ER individual family tier 1 tier 2 tier 3 tier 4

Tufts CareLink Advantage PPO 500/80 80% 60% $500 $1,500 $1,000 $3,000 $5,000 $10,000 $10,000 $20,000 $35 $35 $35 20% 20% $35 $250 n/a n/a $10 $35 $60 n/a

Tufts CareLink Advantage PPO 1000 80% 60% $1,000 $3,000 $2,000 $6,000 $4,500 $9,000 $9,000 $18,000 $35 $35 $35 20% 20% $35 $250 n/a n/a $10 $35 $60 n/a

Tufts CareLink Advantage PPO 1500 80% 60% $1,500 $4,000 $3,000 $8,000 $6,350 $12,700 $10,000 $20,000 $35 $35 $35 20% 20% $35 $250 n/a n/a $10 $35 $60 n/a

Tufts CareLink Advantage Saver PPO HDHP 1500

aggregate deductible option

90% 70% $1,500 $3,000 $4,000 $7,350 10% 10% 10% 10% 10% 10% 10% $10 $35 $60 n/a

Tufts CareLink Advantage Saver PPO HDHP 3000

aggregate deductible option

90% 70% $3,000 $6,000 $4,000 $7,350 10% 10% 10% 10% 10% 10% 10% $10 $35 $60 n/a

Tufts Value HMO 100% n/a n/a n/a n/a n/a $3,000 $6,000 n/a n/a $25 $40 $25 $100 $500 $25 $250 n/a n/a $10 $30 $60 n/a

Tufts Advantage Deductible HMO 1000 100% n/a $1,000 $2,000 n/a n/a $5,000 $10,000 n/a n/a $25 $40 $25 0% 0% $25 $250 n/a n/a $15 $30 $60 n/a

Tufts Advantage Deductible HMO 2000 100% n/a $2,000 $4,000 n/a n/a $6,350 $12,700 n/a n/a $30 $45 $30 0% 0% $30 $250 n/a n/a $15 $30 $60 n/a

Tufts Advantage Saver HMO HDHP 1500

aggregate deductible option

90% n/a $1,500 $3,000 n/a n/a $4,000 $7,350 n/a n/a 10% 10% 10% 10% 10% 10% 10% $10 $35 $60 n/a

Tufts Advantage Saver HMO HDHP 3000

aggregate deductible option

65% n/a $3,000 $6,000 n/a n/a $4,000 $7,350 n/a n/a 35% 35% 35% 35% 35% 35% 35% $15 $30 $60 n/a

Hawaii

(choose regional options only)

in-network

out-of-

network

in-network

individual

in-network

family

out-of-network

individual

out-of-network

family

in-network

individual

in-network

family

out-of-network

individual

out-of-network

family

office visit office visit virtual visit OPS IPH UC ER individual family tier 1 tier 2 tier 3 tier 4

UnitedHealthcare Options PPO 90% 70% $100 $300 $2,500 $7,500 10% 10% $20 10% 10% 10% 10% $10 $15 $30 n/a

$2,500 $7,500

$3,600 $4,200

$10 $35 $35 $200

in-network copay or coinsurance for non-preventive care

the most you will pay before plan pays 100% amount owed before coinsurance applies after deductible

combined in/out of network

combined in/out of network

combined in/out of network

combined in/out of network

no network limitation

no network limitation

no network limitation

combined in/out of network combined in/out of network

medical only

$20n/a n/a $20 $20 $0 10%HMSA BlueCross BlueShield of Hawaii HMO n/a n/a n/a n/a90% n/a 10%

copays apply once medical deductible is met

$100 per member for brand drugs

retail prescription copay medical calendar-year deductible annual out-of-pocket maximum coinsurance prescription deductible

80%

80%

80%

80%

no network limitation

$100 per member for select drugs

no network limitation

no network limitation

no network limitation

no network limitation

n/a

applies to medical OOPM unless

otherwise noted

Kaiser Permanente HMO 100% n/a $20 $20 $20n/a n/a $6,000 n/an/a n/a $2,000 n/a $20 $50 per day $20 $50

Choice Plus and PPO coverage options have in- and out-of-network coverage. HMO coverage options have in-network coverage only. Out-of-Area options have no network limitation. Coverage options have embedded deductibles and OOPMs

unless otherwise noted. Additional limits and exclusions apply. See the Insurer Benefits Description for complete coverage details.

n/a

applies to medical OOPM unless

otherwise noted

copays apply once medical deductible is met

copays apply once medical deductible is met

copays apply once medical deductible is met

copays apply once medical deductible is met

copays apply once medical deductible is met

copays apply once medical deductible is met

$100|$200

$7 $30 $30 + 45

$3 maintenance (generic tier only)

$100

prescription-only OOPM

copays apply once medical deductible is met

copays apply once medical deductible is met

copays apply once medical deductible is met

copays apply once medical deductible is met

6

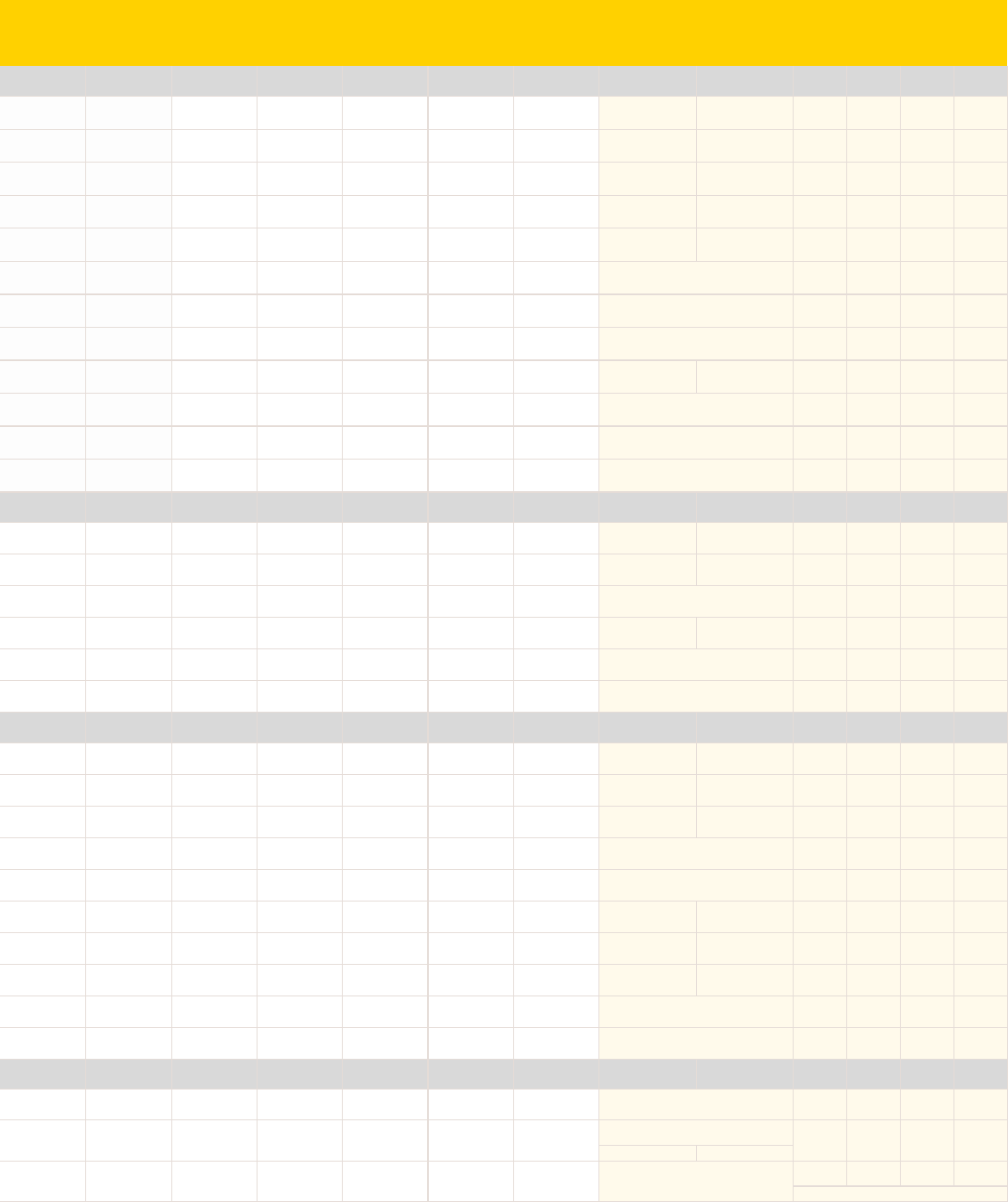

2019 choice medical coverage options at a glance

coverage options

by state physician specialist telemedicine outpatient

surgery

inpatient

hospital

urgent care

clinic

emergency

room

National

in-network

out-of-

network

in-network

individual

in-network

family

out-of-network

individual

out-of-network

family

in-network

individual

in-network

family

out-of-network

individual

out-of-network

family

office visit office visit virtual visit OPS IPH UC ER individual family tier 1 tier 2 tier 3 tier 4

UnitedHealthcare Choice Plus 500/80 80% 60% $500 $1,500 $1,000 $3,000 $5,000 $10,000 $10,000 $20,000 $35 $60 $20 20% 20% $75 $250 $100 $300 $10 $35 $60 $120

UnitedHealthcare Choice Plus 1000 80% 60% $1,000 $3,000 $2,000 $6,000 $4,500 $9,000 $9,000 $18,000 $35 $60 $20 20% 20% $75 $250 $100 $300 $10 $35 $60 $120

UnitedHealthcare Choice Plus 1500 80% 60% $1,500 $4,500 $3,000 $9,000 $6,350 $12,700 $12,700 $25,400 $35 $60 $20 20% 20% $75 $250 $100 $300 $10 $35 $60 $120

UnitedHealthcare Choice Plus 2500 70% 50% $2,500 $7,500 $5,000 $15,000 $6,850 $13,700 $13,700 $27,400 $40 $70 $20 30% 30% $75 $250 $100 $300 $10 $35 $60 $120

UnitedHealthcare Choice Plus 6000 100% 70% $6,000 $13,200 $12,000 $16,400 $7,000 $14,000 $14,000 $28,000 $40 $70 $20 0% 0% $75 $500 $200 $600 $10 $35 $60 $120

UnitedHealthcare Choice Plus HDHP 1500

aggregate deductible option

90% 70% $1,500 $3,000 $3,000 $6,000 $4,000 $7,350 $8,000 $14,700 10% 10% 10% 10% 10% 10% 10% $10 $35 $60 $120

UnitedHealthcare Choice Plus HDHP 3000 90% 70% $3,000 $6,000 $6,000 $12,000 $6,650 $13,300 $13,300 $26,600 10% 10% 10% 10% 10% 10% 10% $10 $35 $60 $120

UnitedHealthcare Choice Plus HDHP 5000 80% 60% $5,000 $10,000 $10,000 $20,000 $6,650 $13,300 $13,300 $26,600 20% 20% 20% 20% 20% 20% 20% $10 $35 $60 $120

UnitedHealthcare Out-of-Area 500 $500 $1,500 $6,350 $12,700 20% 20% $20 20% 20% 20% 20% $100 $300 $10 $35 $60 $120

UnitedHealthcare Out-of-Area HDHP 1500

aggregate deductible option

$1,500 $3,000 $4,000 $7,350 20% 20% 20% 20% 20% 20% 20% $10 $35 $60 $120

UnitedHealthcare Out-of-Area HDHP 3000 $3,000 $6,000 $6,650 $13,300 20% 20% 20% 20% 20% 20% 20% $10 $35 $60 $120

UnitedHealthcare Out-of-Area HDHP 5000 $5,000 $10,000 $6,650 $13,300 20% 20% 20% 20% 20% 20% 20% $10 $35 $60 $120

California

(choose national or regional options)

in-network

out-of-

network

in-network

individual

in-network

family

out-of-network

individual

out-of-network

family

in-network

individual

in-network

family

out-of-network

individual

out-of-network

family

office visit office visit virtual visit OPS IPH UC ER individual family tier 1 tier 2 tier 3 tier 4

UnitedHealthcare of California HMO 100% n/a n/a n/a n/a n/a $3,000 $6,000 n/a n/a $25 $50 $25 $125 $500 $25 $200 n/a n/a $10 $30 $50

specialty rx

30% max

$200

Blue Shield of California HMO 100% n/a n/a n/a n/a n/a $3,000 $6,000 n/a n/a $25 $50 $5 $150 $500 $25 $200 n/a n/a $10 $25 $40

specialty rx

30% max

$200

Blue Shield of California Deductible HMO 1000 90% n/a $1,000 $2,000 n/a n/a $6,050 $12,100 n/a n/a $35 $50 $5 10% 10% $35 10% $10 $30 n/a

specialty rx

30% max

$200

Kaiser Permanente HMO 100% n/a n/a n/a n/a n/a $3,000 $6,000 n/a n/a $25 $50 $0 $100 $250 $25 $200 n/a n/a $10 $30 n/a

specialty rx

30% max

$150

Kaiser Permanente Deductible HMO 1000 70% n/a $1,000 $2,000 n/a n/a $6,050 $12,100 n/a n/a $35 $50 $0 30% 30% $35 30% $10 $30 n/a

specialty rx

30% max

$150

Kaiser Permanente HMO HDHP 90% n/a $2,700 $5,400 n/a n/a $5,200 $10,400 n/a n/a 10% 10% 0% 10% 10% 10% 10% $10 $30 n/a

specialty rx

30% max

$150

Massachusetts

(choose regional options only)

in-network

out-of-

network

in-network

individual

in-network

family

out-of-network

individual

out-of-network

family

in-network

individual

in-network

family

out-of-network

individual

out-of-network

family

office visit office visit virtual visit OPS IPH UC ER individual family tier 1 tier 2 tier 3 tier 4

Tufts CareLink Advantage PPO 500/80 80% 60% $500 $1,500 $1,000 $3,000 $5,000 $10,000 $10,000 $20,000 $35 $35 $35 20% 20% $35 $250 n/a n/a $10 $35 $60 n/a

Tufts CareLink Advantage PPO 1000 80% 60% $1,000 $3,000 $2,000 $6,000 $4,500 $9,000 $9,000 $18,000 $35 $35 $35 20% 20% $35 $250 n/a n/a $10 $35 $60 n/a

Tufts CareLink Advantage PPO 1500 80% 60% $1,500 $4,000 $3,000 $8,000 $6,350 $12,700 $10,000 $20,000 $35 $35 $35 20% 20% $35 $250 n/a n/a $10 $35 $60 n/a

Tufts CareLink Advantage Saver PPO HDHP 1500

aggregate deductible option

90% 70% $1,500 $3,000 $4,000 $7,350 10% 10% 10% 10% 10% 10% 10% $10 $35 $60 n/a

Tufts CareLink Advantage Saver PPO HDHP 3000

aggregate deductible option

90% 70% $3,000 $6,000 $4,000 $7,350 10% 10% 10% 10% 10% 10% 10% $10 $35 $60 n/a

Tufts Value HMO 100% n/a n/a n/a n/a n/a $3,000 $6,000 n/a n/a $25 $40 $25 $100 $500 $25 $250 n/a n/a $10 $30 $60 n/a

Tufts Advantage Deductible HMO 1000 100% n/a $1,000 $2,000 n/a n/a $5,000 $10,000 n/a n/a $25 $40 $25 0% 0% $25 $250 n/a n/a $15 $30 $60 n/a

Tufts Advantage Deductible HMO 2000 100% n/a $2,000 $4,000 n/a n/a $6,350 $12,700 n/a n/a $30 $45 $30 0% 0% $30 $250 n/a n/a $15 $30 $60 n/a

Tufts Advantage Saver HMO HDHP 1500

aggregate deductible option

90% n/a $1,500 $3,000 n/a n/a $4,000 $7,350 n/a n/a 10% 10% 10% 10% 10% 10% 10% $10 $35 $60 n/a

Tufts Advantage Saver HMO HDHP 3000

aggregate deductible option

65% n/a $3,000 $6,000 n/a n/a $4,000 $7,350 n/a n/a 35% 35% 35% 35% 35% 35% 35% $15 $30 $60 n/a

Hawaii

(choose regional options only)

in-network

out-of-

network

in-network

individual

in-network

family

out-of-network

individual

out-of-network

family

in-network

individual

in-network

family

out-of-network

individual

out-of-network

family

office visit office visit virtual visit OPS IPH UC ER individual family tier 1 tier 2 tier 3 tier 4

UnitedHealthcare Options PPO 90% 70% $100 $300 $2,500 $7,500 10% 10% $20 10% 10% 10% 10% $10 $15 $30 n/a

$2,500 $7,500

$3,600 $4,200

$10 $35 $35 $200

in-network copay or coinsurance for non-preventive care

the most you will pay before plan pays 100% amount owed before coinsurance applies after deductible

combined in/out of network

combined in/out of network

combined in/out of network

combined in/out of network

no network limitation

no network limitation

no network limitation

combined in/out of network combined in/out of network

medical only

$20n/a n/a $20 $20 $0 10%HMSA BlueCross BlueShield of Hawaii HMO n/a n/a n/a n/a90% n/a 10%

copays apply once medical deductible is met

$100 per member for brand drugs

retail prescription copay medical calendar-year deductible annual out-of-pocket maximum coinsurance prescription deductible

80%

80%

80%

80%

no network limitation

$100 per member for select drugs

no network limitation

no network limitation

no network limitation

no network limitation

n/a

applies to medical OOPM unless

otherwise noted

Kaiser Permanente HMO 100% n/a $20 $20 $20n/a n/a $6,000 n/an/a n/a $2,000 n/a $20 $50 per day $20 $50

Choice Plus and PPO coverage options have in- and out-of-network coverage. HMO coverage options have in-network coverage only. Out-of-Area options have no network limitation. Coverage options have embedded deductibles and OOPMs

unless otherwise noted. Additional limits and exclusions apply. See the Insurer Benefits Description for complete coverage details.

n/a

applies to medical OOPM unless

otherwise noted

copays apply once medical deductible is met

copays apply once medical deductible is met

copays apply once medical deductible is met

copays apply once medical deductible is met

copays apply once medical deductible is met

copays apply once medical deductible is met

$100|$200

$7 $30 $30 + 45

$3 maintenance (generic tier only)

$100

prescription-only OOPM

copays apply once medical deductible is met

copays apply once medical deductible is met

copays apply once medical deductible is met

copays apply once medical deductible is met

7

Dental benets at a glance

Insperity dental and vision benefits must be elected together, but may be elected independently of medical coverage.

Benefits are generally available to eligible employees nationwide (if included in Insperity benefits package).

Benefit levels shown below are in-network. Services received from non-network providers will be paid at reasonable and

customary rates, and the participant will be responsible for any remaining balance.

• Preventive and diagnostic services include routine exams, cleaning, topical application of fluoride, diagnostic cast,

bite-wing x-rays, sealants and space maintainers.

• Basic (restorative) services include extractions, fillings, oral surgery, palliative emergency treatment, apicoectomy,

occlusal guards, periodontic services, root canal therapy, and therapeutic pulpotomy.

• Major services include inlays, crowns, bridges, dentures, denture rebase or reline, repair of removable dentures,

re-cementing of crowns and bridges, and repairs to fixed bridges.

• Orthodontic services include braces, retainers, and other appliances that correct misalignments for dependent

children to age 19 only.

• There is no coverage for placement/replacement of dental implants, implant-supported crowns, implant-supporting

structures, abutments or prostheses.

Additional limits and exclusions apply; see the Insurer Benefits Description for complete coverage details.

ID cards are issued when enrollment is processed.

UnitedHealthcare Dental | myuhc.com | 877.816.3596

calendar-year

deductible

per person

calendar-year

maximum

per person

orthodontia

lifetime

maximum

preventative and

diagnostic

services

basic

services

major

services

orthodontic

services

$50

$150 max per family

$1500

per year

$1500

to age 19 only

plan pays 100%

no deductible

plan pays 80%

aer deductible

plan pays 50%

aer deductible

plan pays 50%

no deductible

portal.insperity.com 8 866.715.3552

Vision benets at a glance

Insperity dental and vision benefits must be elected together, but may be elected independently of medical coverage.

Benefits are generally available to eligible employees nationwide (if included in Insperity benefits package).

Benefit levels shown below are in-network. The plan generally pays 100% of eligible expenses aer copay when network

providers are used. Services from non-network providers must be paid at full cost by the participant at the time of service. A

claim may then be filed for reimbursement of eligible expenses up to the out-of-network benefit allowance.

• You may receive a benefit for either glasses (lenses and frames) or contact lenses per 12-month period, but not both.

• Diabetic Eyecare Program Plus provides medical exams for diabetic eye disease, glaucoma, and age-related macular

degeneration (AMD), as well as retinal screening for eligible members with diabetes, at a $20 copay. Limitations and

coordination with medical coverage may apply.

• Retinal screening for non-diabetic members is covered on an as-needed basis aer a $39 copay.

• Visually necessary contact lenses are covered 100% aer a $25 copay upon review and authorization by VSP.

• Progressive, polycarbonate, tinted and photochromic lenses, as well as anti-reflective or scratch-resistant coatings

and other lens enhancements, will generally receive a 20-25% discount off provider price aer base lens copay.

• Additional discounts for contact lens exams, laser eye surgery, eyeglass frames, sunglass frames and other eligible

items are available.

Additional limits and exclusions apply; see the Insurer Benefits Description for complete coverage details.

No ID card is required. Simply tell your network provider you are a VSP member.

Vision Service Plan | vsp.com | 800.877.7195

WellVision

®

exam

every 12 months

glasses frames

every 24 months

single vision lenses

every 12 months

lined bifocal lenses

every 12 months

lined trifocal lenses

every 12 months

lenticular lenses

every 12 months

contact lens

every 12 months

$15

copay

up to $130

frame allowance

$25

copay

$25

copay

$25

copay

$25

copay

up to $125

lens/exam allowance

portal.insperity.com 9 866.715.3552

portal.insperity.com

866.715.3552

Rev. 09-01-18 | 70-032